Page 1 of 1

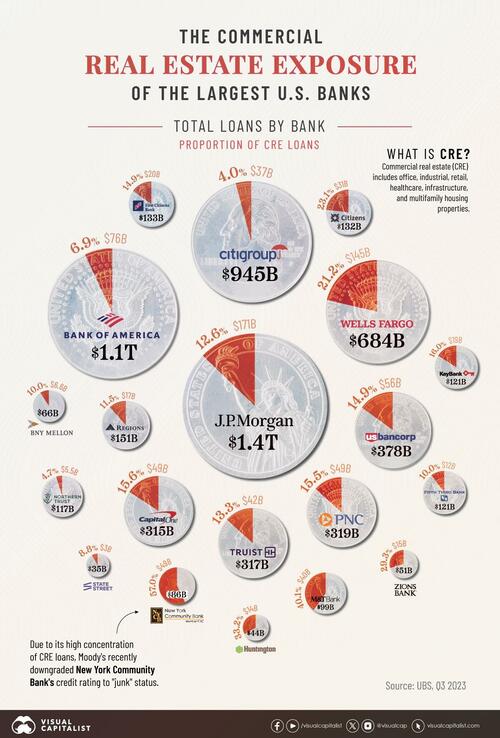

The Coming Bank CRE Crisis

Posted:

Tue Mar 19, 2024 6:15 amby Lemon Thrower

Chart shows nominal and percent-of-assets exposure to CRE.

Watch out for M&T and Wells Fargo, Citizens, and Zions who have relatively high percentages.

https://www.zerohedge.com/markets/visua ... e-exposure

https://www.zerohedge.com/markets/visua ... e-exposure

Re: The Coming Bank CRE Crisis

Posted:

Tue Mar 19, 2024 3:00 pmby silverflake

Nice chart! Scary predicament.

So, what's next?

Keep stacking!

Re: The Coming Bank CRE Crisis

Posted:

Tue Mar 19, 2024 3:52 pmby Lemon Thrower

What's next is you are going to hear a lot about this soon. Its worse than SVB - that was a case where banks bought bonds paying say 3% and the market rate zoomed to 6%, roughly devaluing their holdings in half. From an accounting perspective they don't have to fess up to the loss as long as they intend to hold the bonds to maturity. CRE is similar with the key difference being that in a lot of cases they can't hold the loans to maturity. That's because there are a lot of renewals coming due. The tenants can't afford interest at the market rate, and the banks can't afford to subsidize the ownership of buildings that in many cases are worth half as much as when the loans were extended. This is a quirk of CRE financing - unlike residential where you lock in a loan for say 30 years, CRE often has a balloon payment in 5 or 10 year, requiring the owner to refinance.

You are going to hear about some big losses in dollar terms but the real risk is in percentage terms. Poop will hit the fan late June early July when stress test results are published.

Re: The Coming Bank CRE Crisis

Posted:

Tue Mar 19, 2024 5:31 pmby pmbug

...

Of about 4,000 U.S. banks analyzed by consulting firm Klaros Group, 282 institutions have both high levels of commercial real estate exposure and large unrealized losses from the rate surge — a potentially toxic combo that may force these lenders to raise fresh capital or engage in mergers.

...

https://www.cnbc.com/2024/03/19/where-c ... re-ma.html

Re: The Coming Bank CRE Crisis

Posted:

Wed Mar 20, 2024 9:15 pmby shinnosuke

Another unintended consequence of many employees suddenly working at home starting in 2020?

Re: The Coming Bank CRE Crisis

Posted:

Thu Mar 21, 2024 5:42 amby Lemon Thrower

shinnosuke wrote:Another unintended consequence of many employees suddenly working at home starting in 2020?

Yes, to some extent, but more a function of the Politburo setting rates too low for too long. Commercial real estate was over built. Now, when rates went up, the fact that it was overbuilt is obvious.

Re: The Coming Bank CRE Crisis

Posted:

Thu Mar 21, 2024 7:05 amby shinnosuke

Yep, future demand was massively "pulled forward" by the rates being artificially too low. Now the normal demand just doesn't exist.

New article on ZH:

https://www.zerohedge.com/markets/goldm ... rowed-time

Re: The Coming Bank CRE Crisis

Posted:

Sat Apr 06, 2024 9:19 amby Lemon Thrower

Gold, silver and oil rallying. Gold and silver were due, but oil rallying in the face of slowing demand and a $40-50 pull rate for US fracked oil is a head scratcher.

I think some people know what's coming in banking. Just a guess.

Re: The Coming Bank CRE Crisis

Posted:

Sat Apr 06, 2024 10:39 amby 68Camaro

It suggests a larger non-US loss of faith in the dollar such that some are converting dollars to commodities, including but not limited to central banks. Enough that they are affecting price of the commodities. That said, the US dollar itself seems like it is being propped up to stay over 104, which flies in the face of a loss of faith. I wonder how long this can keep up. I feel like we're seeing two diverging paths.

May you live in interesting times... we certainly are

Re: The Coming Bank CRE Crisis

Posted:

Sat Apr 06, 2024 2:36 pmby pmbug

Lemon Thrower wrote:... but oil rallying in the face of ...

FWIW:

https://twitter.com/RevShark/status/1775961967905161254

Re: The Coming Bank CRE Crisis

Posted:

Sat Apr 06, 2024 4:42 pmby Lemon Thrower

I think that's it pmbug - expected action in the middle east.

Re: The Coming Bank CRE Crisis

Posted:

Sat Apr 06, 2024 5:38 pmby Recyclersteve

For someone with exposure to the stock market who would like to profit from the above scenario, you can do one or even all of the following:

1) Selling one or more stocks short and profiting when they collapse;

2) Buying long put options; and

3) Selling naked call options (a higher risk level and many brokers want to test you to make sure you have the smarts and capital to back you up before they will allow you to trade naked options).