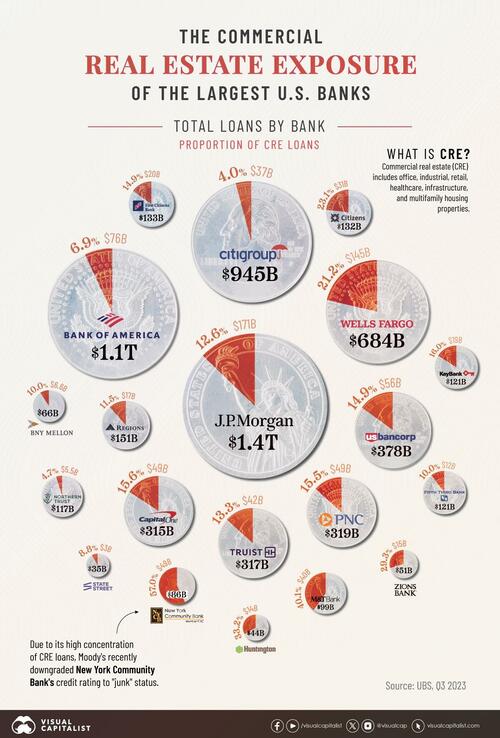

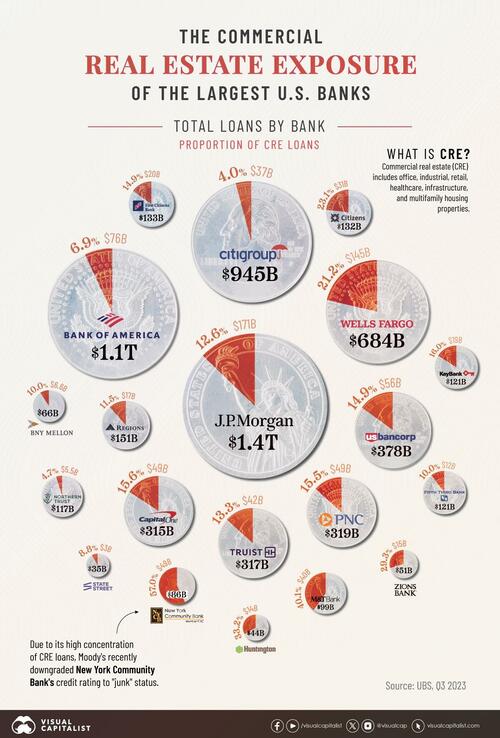

Watch out for M&T and Wells Fargo, Citizens, and Zions who have relatively high percentages.

https://www.zerohedge.com/markets/visua ... e-exposure

...

Of about 4,000 U.S. banks analyzed by consulting firm Klaros Group, 282 institutions have both high levels of commercial real estate exposure and large unrealized losses from the rate surge — a potentially toxic combo that may force these lenders to raise fresh capital or engage in mergers.

...

shinnosuke wrote:Another unintended consequence of many employees suddenly working at home starting in 2020?

Lemon Thrower wrote:... but oil rallying in the face of ...

Return to Economic & Business News, Reports, and Predictions

Users browsing this forum: No registered users and 21 guests