Hey Recyclersteve, MSTR of no interest to you?

53 posts

• Page 2 of 3 • 1, 2, 3

Re: Hey Recyclersteve, MSTR of no interest to you?

Steve, I hope you will share all the gory details with us until you close your short.

Why don't you just buy some Bitcoin for all the excitement it provides?

Why don't you just buy some Bitcoin for all the excitement it provides?

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them... (Thomas Jefferson)

-

shinnosuke - Super Post Hoarder

- Posts: 3740

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

Very exciting

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them... (Thomas Jefferson)

-

shinnosuke - Super Post Hoarder

- Posts: 3740

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

Michael Saylor has lost voting control of MicroStrategy

https://protos.com/michael-saylor-has-l ... ostrategy/

However, because MicroStrategy has issued so many shares and debt to buy bitcoin, including today’s upsized round, Saylor’s voting control is now less than 50%.

https://protos.com/michael-saylor-has-l ... ostrategy/

There are more ways than one to skin a cat.

-

tdtwedt - Penny Hoarding Member

- Posts: 514

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

TYSONS CORNER, Va., November 20, 2024 — MicroStrategy® Incorporated (Nasdaq: MSTR) (“MicroStrategy”) today announced the pricing of its offering of $2.6 billion aggregate principal amount of its 0% convertible senior notes due 2029 (the “notes”). https://www.microstrategy.com/press/mic ... 11-20-2024

"Eric Weiss @Eric_BIGfund

Hey @PeterSchiff is the market willing to give you $2.6+ billion at 0% for 5yrs to buy gold?"

Even if Saylor wasn't making so much money, the entertainment value is high, especially with Schiff involved. Personally, I believe Schiff owns Bitcoin (he has already admitted that his son does) and he is trash-talking it to try to improve his entry points. Crazy theory. No proof.

"Eric Weiss @Eric_BIGfund

Hey @PeterSchiff is the market willing to give you $2.6+ billion at 0% for 5yrs to buy gold?"

Even if Saylor wasn't making so much money, the entertainment value is high, especially with Schiff involved. Personally, I believe Schiff owns Bitcoin (he has already admitted that his son does) and he is trash-talking it to try to improve his entry points. Crazy theory. No proof.

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them... (Thomas Jefferson)

-

shinnosuke - Super Post Hoarder

- Posts: 3740

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

Hey, Steve. If you’re up to watching a 4.5 minute video about MSTR, click on the link below. I don’t want you to lose money on your short position.

https://x.com/adelgary/status/1859330327233036727?s=46

https://x.com/adelgary/status/1859330327233036727?s=46

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them... (Thomas Jefferson)

-

shinnosuke - Super Post Hoarder

- Posts: 3740

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

OK, just for those who want to understand how Microstrategy is doing so well, I'm going to copy/paste a thread from X. Keep your hands and feet in the vehicle at all times. This is going to be a wild ride.

(begin quote)

Dan @Kingbingo_

Something crazy is happening in money - you might want to give this thread 5 minutes.

Moneys value is being printed away - we all see the absurd inflation.

But one company may have found a way to create an infinite money glitch. Actually free money - forever.

#MSTR

Why would you care? Well let's assume you are a comfortable middle class person who had a spare $100,000 and you invested in MSTR The day before Trump won.

This is what your daily returns would have looked like:

Nov 6: +$13.1k

Nov 7: +$5.7k

Nov 8: -$171

Nov 11: +$30.5k

Nov 12: +$7.2k

Nov 13: -$12k

Nov 14: -$312

Nov 15: +$5.7k

Nov 18: +$19.4k

Nov 19: +$20k

Today: +$26k

Total + $115,101 - In two weeks!

(This isn't directly a Trump Trade stock - but his win unleashed a more positive sentiment)

During COVID, when money printing went wild, a small NASDAQ company: MicroStrategy (MSTR) realized its $400M cash was losing value fast.

Rather than take the hit or return the cash to shareholders, they converted it into Bitcoin.

That was new, but the story gets crazier.

MSTR traded at a premium over its Bitcoin holdings plus its original business value.

Why? Many people wanted exposure to Bitcoin but found it hard to buy directly, especially in pensions or restrictive countries.

Usually, a premium is bad, but here's where the magic starts.

MSTR realized they could issue new shares-normally dilutive = bad - but then use the proceeds to buy more Bitcoin.

This temporarily lowers the premium, but as Bitcoin reserves increase, the premium returns. Shareholders gain a stronger reserve and higher share price—a win-win.

Simple example: MSTR holds 100 BTC but is valued at 300 BTC equivalent—a 3x premium.

It issues new shares worth 100 BTC and buys 100 more BTC. Now it holds 200 BTC, valued at 400 BTC—a 2x premium.

But as the premium returns to 3x, the value becomes 600 BTC. Shareholders get more BTC and higher share price—for free.

Normally, dilution is bad—like watering down wine. But if someone keeps turning that water into even better wine, you'd welcome it.

That's what's happening: melting fiat money is converted into hard money (Bitcoin), and you end up with more of both. But it gets even crazier!

MSTR is adding Btc to its holdings, and Btc is growing at 30-50%. Public companies trade at multiples NVIDIA trades at 70x earnings. If MSTR adds 10% more BTC and BTC grows 30%, that's 30x10%=300%. That's why a 3x premium is justified.

MSTR realized it could use future higher share prices to generate greater returns. With Convertible Bonds. It's debt that pays interest and redeems like any bond, but at higher share prices, it converts into MSTR equity. So, it acts like a bond when low, a share when high.

Traders love trading volatility (VOL). They buy when prices drop and sell when they rise - the opposite of many amateur investors. MSTR's convertible bond ticks all the boxes: you can buy at low VOL, sell high VOL, and it has a strong balance sheet-great creditworthiness.

The massive convertible bond market went wild for these bonds. Even better, these bonds kept converting, generating returns of 90%+ for investors. That's insane for a bond—everyone wants them. So how does this help shareholders?

Because MSTR can use this debt to buy Btc. It's now leveraging not today's premium, but the premium from a year or more in the future. The flywheel effect accelerates- harvesting future returns today. Instead of investing and waiting, MSTR brings future gains into the present.

The limiting factor: before these bonds convert, they're still bonds, requiring a coupon. So scale of this magic is limited by MSTR's cash flow from its software consulting business. For example, $50M cash flow at 4% interest lets you borrow $1.25B to feed the flywheel.

But then this happened: demand for these high-return bonds is so great that investors have pushed the interest rate to ZERO. Giving MSTR money for FREE - for bonds that convert with high returns. Now, there's no limit to how fast this can progress.

THIS IS NOT FINANCIAL ADVICE. This situation is hot, maybe it blows up somehow. But what if this keeps flowing? Read this and decide for yourself:

Just Some Guy @catchthe_wave3

I was speaking with a friend of mine who is a PM at a large investment firm. The topic of MSTR came up, and he opined that Saylor may eventually run out of homes for the convertible bonds placements. So I asked him three questions: 1. "How many billions in pensions does your firm manage?" He responded with a 12-digit number which I won't share. 2. "How many of those pensions are restricted from buying anything other than fixed income securities?" He said around 30-35%. 3. Finally I asked, "What percentage of those 35% are underfunded?" Answer: 90%. I raised my eyebrows to implore him to take the next step, gave it a second to register with him, and then his eyes got large, followed by a "HOLY SHlT!" It suddenly struck him that all these underfunded pensions would kill to have a fixed income security that could provide BTC-esque returns. Stats show that as of June 2023, public pension plans in the United States were 77% funded, meaning that there was a shortfall of about $1.49 trillion. Just like a US strategic BTC reserve could eventually wipe away our debt, so too could MSTR convertibles cure the shortfall of pensions. Think those that can only invest in fixed income securities want access to this lifeline?! I think there is an almost unlimited demand for these MSTR convertible bonds. This is even more evident by the fact that they are offering them at 0%. (end quote)

I hope this Great LEE improved your outlook on Saylor.

(begin quote)

Dan @Kingbingo_

Something crazy is happening in money - you might want to give this thread 5 minutes.

Moneys value is being printed away - we all see the absurd inflation.

But one company may have found a way to create an infinite money glitch. Actually free money - forever.

#MSTR

Why would you care? Well let's assume you are a comfortable middle class person who had a spare $100,000 and you invested in MSTR The day before Trump won.

This is what your daily returns would have looked like:

Nov 6: +$13.1k

Nov 7: +$5.7k

Nov 8: -$171

Nov 11: +$30.5k

Nov 12: +$7.2k

Nov 13: -$12k

Nov 14: -$312

Nov 15: +$5.7k

Nov 18: +$19.4k

Nov 19: +$20k

Today: +$26k

Total + $115,101 - In two weeks!

(This isn't directly a Trump Trade stock - but his win unleashed a more positive sentiment)

During COVID, when money printing went wild, a small NASDAQ company: MicroStrategy (MSTR) realized its $400M cash was losing value fast.

Rather than take the hit or return the cash to shareholders, they converted it into Bitcoin.

That was new, but the story gets crazier.

MSTR traded at a premium over its Bitcoin holdings plus its original business value.

Why? Many people wanted exposure to Bitcoin but found it hard to buy directly, especially in pensions or restrictive countries.

Usually, a premium is bad, but here's where the magic starts.

MSTR realized they could issue new shares-normally dilutive = bad - but then use the proceeds to buy more Bitcoin.

This temporarily lowers the premium, but as Bitcoin reserves increase, the premium returns. Shareholders gain a stronger reserve and higher share price—a win-win.

Simple example: MSTR holds 100 BTC but is valued at 300 BTC equivalent—a 3x premium.

It issues new shares worth 100 BTC and buys 100 more BTC. Now it holds 200 BTC, valued at 400 BTC—a 2x premium.

But as the premium returns to 3x, the value becomes 600 BTC. Shareholders get more BTC and higher share price—for free.

Normally, dilution is bad—like watering down wine. But if someone keeps turning that water into even better wine, you'd welcome it.

That's what's happening: melting fiat money is converted into hard money (Bitcoin), and you end up with more of both. But it gets even crazier!

MSTR is adding Btc to its holdings, and Btc is growing at 30-50%. Public companies trade at multiples NVIDIA trades at 70x earnings. If MSTR adds 10% more BTC and BTC grows 30%, that's 30x10%=300%. That's why a 3x premium is justified.

MSTR realized it could use future higher share prices to generate greater returns. With Convertible Bonds. It's debt that pays interest and redeems like any bond, but at higher share prices, it converts into MSTR equity. So, it acts like a bond when low, a share when high.

Traders love trading volatility (VOL). They buy when prices drop and sell when they rise - the opposite of many amateur investors. MSTR's convertible bond ticks all the boxes: you can buy at low VOL, sell high VOL, and it has a strong balance sheet-great creditworthiness.

The massive convertible bond market went wild for these bonds. Even better, these bonds kept converting, generating returns of 90%+ for investors. That's insane for a bond—everyone wants them. So how does this help shareholders?

Because MSTR can use this debt to buy Btc. It's now leveraging not today's premium, but the premium from a year or more in the future. The flywheel effect accelerates- harvesting future returns today. Instead of investing and waiting, MSTR brings future gains into the present.

The limiting factor: before these bonds convert, they're still bonds, requiring a coupon. So scale of this magic is limited by MSTR's cash flow from its software consulting business. For example, $50M cash flow at 4% interest lets you borrow $1.25B to feed the flywheel.

But then this happened: demand for these high-return bonds is so great that investors have pushed the interest rate to ZERO. Giving MSTR money for FREE - for bonds that convert with high returns. Now, there's no limit to how fast this can progress.

THIS IS NOT FINANCIAL ADVICE. This situation is hot, maybe it blows up somehow. But what if this keeps flowing? Read this and decide for yourself:

Just Some Guy @catchthe_wave3

I was speaking with a friend of mine who is a PM at a large investment firm. The topic of MSTR came up, and he opined that Saylor may eventually run out of homes for the convertible bonds placements. So I asked him three questions: 1. "How many billions in pensions does your firm manage?" He responded with a 12-digit number which I won't share. 2. "How many of those pensions are restricted from buying anything other than fixed income securities?" He said around 30-35%. 3. Finally I asked, "What percentage of those 35% are underfunded?" Answer: 90%. I raised my eyebrows to implore him to take the next step, gave it a second to register with him, and then his eyes got large, followed by a "HOLY SHlT!" It suddenly struck him that all these underfunded pensions would kill to have a fixed income security that could provide BTC-esque returns. Stats show that as of June 2023, public pension plans in the United States were 77% funded, meaning that there was a shortfall of about $1.49 trillion. Just like a US strategic BTC reserve could eventually wipe away our debt, so too could MSTR convertibles cure the shortfall of pensions. Think those that can only invest in fixed income securities want access to this lifeline?! I think there is an almost unlimited demand for these MSTR convertible bonds. This is even more evident by the fact that they are offering them at 0%. (end quote)

I hope this Great LEE improved your outlook on Saylor.

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them... (Thomas Jefferson)

-

shinnosuke - Super Post Hoarder

- Posts: 3740

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

MSTR just sold $2.6B of bonds at ZERO PERCENT INTEREST. They are convertible to MSTR but only after the stock price has increased 55%.

ZERO PERCENT INTEREST. The bond market is rushing out of FRNs to BTC.

ZERO PERCENT INTEREST. The bond market is rushing out of FRNs to BTC.

Lets Go Brandon!

-

Lemon Thrower - Super Post Hoarder

- Posts: 3870

- Joined: Fri Jun 13, 2008 10:00 am

Re: Hey Recyclersteve, MSTR of no interest to you?

Lemon Thrower wrote:$530 already this morning.

It would sure suck to be in MSTR if Bitcoin were to crash on the weekend when the NASDAQ is closed.

There are more ways than one to skin a cat.

-

tdtwedt - Penny Hoarding Member

- Posts: 514

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

(begin quote) "Stack Hodler @stackhodler

What you're seeing with MicroStrategy is just the beginning.

This is way bigger than just a massive MSTR pump.

Saylor is making it brutally obvious that you either buy Bitcoin, or you fall behind.

And this could be the tumbling domino that leads to hyper-Bitcoinization.

The idea is simple: Convert as much fiat capital into finite Bitcoin as possible.

Use Bitcoin's performance to attract yield-starved investors.

And do it as aggressively as possible.

MicroStrategy doesn't have a monopoly on this strategy.

Semler Scientific is another company working this strategy.

They were up 27.9% yesterday, and they're up another 20% pre-market this morning." (end quote)

Now a Japanese company is following Microstrategy's formula:

"Metaplanet is Japan’s MicroStrategy

Metaplanet’s board of directors resolved to issue the third series ordinary bonds during a meeting held on November 18, 2024, according to a regulatory disclosure. The bondholder will be EVO FUND, while the bonds will mature on November 17, 2025.

In Oct., Metaplanet announced it had adopted ‘BTC Yield’ as a key performance indicator. This followed the industry pioneer MicroStrategy whose strategy continues to inspire several other companies. On its part, MicroStrategy is eyeing $42 billion in capital over the next two-to-three years to buy Bitcoin.

Earlier this month, Michael Saylor revealed the US-based firm had acquired an addition 27,200 BTC for over $2 billion. Since the company started buying the scarce asset, it has hoarded 279,420 bitcoins purchased for over $11.9 billion." https://coinjournal.net/news/metaplanet ... n-bitcoin/

Things are getting spicy out there.

What you're seeing with MicroStrategy is just the beginning.

This is way bigger than just a massive MSTR pump.

Saylor is making it brutally obvious that you either buy Bitcoin, or you fall behind.

And this could be the tumbling domino that leads to hyper-Bitcoinization.

The idea is simple: Convert as much fiat capital into finite Bitcoin as possible.

Use Bitcoin's performance to attract yield-starved investors.

And do it as aggressively as possible.

MicroStrategy doesn't have a monopoly on this strategy.

Semler Scientific is another company working this strategy.

They were up 27.9% yesterday, and they're up another 20% pre-market this morning." (end quote)

Now a Japanese company is following Microstrategy's formula:

"Metaplanet is Japan’s MicroStrategy

Metaplanet’s board of directors resolved to issue the third series ordinary bonds during a meeting held on November 18, 2024, according to a regulatory disclosure. The bondholder will be EVO FUND, while the bonds will mature on November 17, 2025.

In Oct., Metaplanet announced it had adopted ‘BTC Yield’ as a key performance indicator. This followed the industry pioneer MicroStrategy whose strategy continues to inspire several other companies. On its part, MicroStrategy is eyeing $42 billion in capital over the next two-to-three years to buy Bitcoin.

Earlier this month, Michael Saylor revealed the US-based firm had acquired an addition 27,200 BTC for over $2 billion. Since the company started buying the scarce asset, it has hoarded 279,420 bitcoins purchased for over $11.9 billion." https://coinjournal.net/news/metaplanet ... n-bitcoin/

Things are getting spicy out there.

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them... (Thomas Jefferson)

-

shinnosuke - Super Post Hoarder

- Posts: 3740

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

Lemon Thrower wrote:$530 already this morning.

$395 right now.

Did the bubble pop?

There are more ways than one to skin a cat.

-

tdtwedt - Penny Hoarding Member

- Posts: 514

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Looks like a short call got made by a research company.

In the game of Woke, the goal posts can be moved at any moment, the penalties will apply retroactively and claims of fairness will always lose out to the perpetual right to claim offense.... Bret Stephens

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

-

68Camaro - Too Busy Posting to Hoard Anything Else

- Posts: 8374

- Joined: Thu Dec 30, 2010 6:12 am

- Location: Disney World

Re: Hey Recyclersteve, MSTR of no interest to you?

68Camaro wrote:Looks like a short call got made by a research company.

May the best man win.

"BRITISH HODL @BritishHodl

MSTR bears should ask themselves today why anyone - let alone masters of finance at institutional levels - would give @saylor $3bn of unsecured debt AGAIN, $400m more than what he asked for at a 0% interest rate to buy #Bitcoin and are happy to wait for the share price to get to $672 before they can get their equity and exit the trade AFTER Saylor already said he'll be diluting $42 Billion from the value of the stock."

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them... (Thomas Jefferson)

-

shinnosuke - Super Post Hoarder

- Posts: 3740

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

Peter Schiff today...

https://x.com/PeterSchiff/status/1859718417319854434

Based on today's rise in #Bitcoin and the reversal in $MSTR, which sold another $3 billion in convertible debt to buy more Bitcoin, MSTR was likely today's big Bitcoin buyer. The game ends when MSTR runs out of suckers willing to lend it money and buy its overpriced shares.

https://x.com/PeterSchiff/status/1859718417319854434

There are more ways than one to skin a cat.

-

tdtwedt - Penny Hoarding Member

- Posts: 514

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Schwab joins the fun. Probably nothing.

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them... (Thomas Jefferson)

-

shinnosuke - Super Post Hoarder

- Posts: 3740

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

Ok, I had to say something so here goes...

Here is an update on my short position in MSTR (MicroStrategy). I shorted only 3 shares on Tuesday, fully expecting that MSTR could go much higher and likely above $500. Today, in the first few minutes the price hit an all-time high of $542.99. It then stated coming down hard and fast. After the first 30 minutes it went below $500 and never went back above $500- not a good sign.

Admittedly, I was busy trading and watching other items and didn't see MSTR til it was down to about $420. I was immediately interested, even though I was trying to watch another high flyer (LUNR) at the same time. Volume in MSTR was already well above normal and there was already technical damage to the chart. I envisioned short sellers and hedge funds everywhere licking their chops at the thought of shorting MSTR. I was able to still get shares from Schwab to short without paying any fee whatsoever, which was fantastic and good news for short sellers everywhere. Remember, this same stock was only $113.69 on 9/6/24, so it was definitely overheated IMHO.

I shorted an additional 22 shares of MSTR today (25 total) as follows:

3 shares at $417.97 (Tuesday)

7 shares at $415.47 (today)

15 shares at $422.00 (today)

Ten minutes before the market closed today I bought back to cover (get out of) my short position. I bought back at $379.06, and the stock was only below $380 VERY VERY BRIEFLY. I may have been within 60-90 seconds of the low for the day. My total net profit was $1,015.43 (10.7%) in just 2 days. I'll take it!

When the stock popped again in after hours I shorted it again! I'm not close to betting the ranch and can do more shares if need be. I'm VERY COMFORTABLE being short right now. I feel for some people who blindly think CEO Saylor is the second coming of you know who. Andrew Left of Citron Research said today that even Saylor likely knows his stock is due for a significant pullback- or words to that effect.

Now I'll read all the other comments from the past few days...

Here is an update on my short position in MSTR (MicroStrategy). I shorted only 3 shares on Tuesday, fully expecting that MSTR could go much higher and likely above $500. Today, in the first few minutes the price hit an all-time high of $542.99. It then stated coming down hard and fast. After the first 30 minutes it went below $500 and never went back above $500- not a good sign.

Admittedly, I was busy trading and watching other items and didn't see MSTR til it was down to about $420. I was immediately interested, even though I was trying to watch another high flyer (LUNR) at the same time. Volume in MSTR was already well above normal and there was already technical damage to the chart. I envisioned short sellers and hedge funds everywhere licking their chops at the thought of shorting MSTR. I was able to still get shares from Schwab to short without paying any fee whatsoever, which was fantastic and good news for short sellers everywhere. Remember, this same stock was only $113.69 on 9/6/24, so it was definitely overheated IMHO.

I shorted an additional 22 shares of MSTR today (25 total) as follows:

3 shares at $417.97 (Tuesday)

7 shares at $415.47 (today)

15 shares at $422.00 (today)

Ten minutes before the market closed today I bought back to cover (get out of) my short position. I bought back at $379.06, and the stock was only below $380 VERY VERY BRIEFLY. I may have been within 60-90 seconds of the low for the day. My total net profit was $1,015.43 (10.7%) in just 2 days. I'll take it!

When the stock popped again in after hours I shorted it again! I'm not close to betting the ranch and can do more shares if need be. I'm VERY COMFORTABLE being short right now. I feel for some people who blindly think CEO Saylor is the second coming of you know who. Andrew Left of Citron Research said today that even Saylor likely knows his stock is due for a significant pullback- or words to that effect.

Now I'll read all the other comments from the past few days...

Former stock broker w/ ~20 yrs. at one company. Spoke with 100k+ people and traded a lot (long, short, options, margin, extended hours, etc.).

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

- Recyclersteve

- Too Busy Posting to Hoard Anything Else

- Posts: 4591

- Joined: Sun Jan 20, 2013 5:59 am

- Location: Where I Want To Be

Re: Hey Recyclersteve, MSTR of no interest to you?

shinnosuke wrote:The Bitcoin Historian

@pete_rizzo_

HISTORY: MicroStrategy bought $4.6 BILLION worth of #Bitcoin today

The largest-ever purchase of $BTC in a single day. RIP bears.

RIP bears? I’m thinking the exact opposite. Way too many people are drinking the Koolaid and that includes people who have gold and silver, which can be melted down and used for tons of items. This reminds me of tech stocks in 1999-2000 and that did NOT end well. See my additional comment below.

Former stock broker w/ ~20 yrs. at one company. Spoke with 100k+ people and traded a lot (long, short, options, margin, extended hours, etc.).

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

- Recyclersteve

- Too Busy Posting to Hoard Anything Else

- Posts: 4591

- Joined: Sun Jan 20, 2013 5:59 am

- Location: Where I Want To Be

Re: Hey Recyclersteve, MSTR of no interest to you?

shinnosuke wrote:"Peter Schiff

@PeterSchiff

The higher the price of $MSTR stock, the more shares @Saylor can sell. The more shares he sells, the more #Bitcoin he can buy. The more Bitcoin he buys, the higher the Bitcoin price rises. When the price of Bitcoin goes up, the share price of MSTR goes up more. When does it end?

11:00 AM · Nov 19, 2024"

Peter is sad because interest in BTC cuts into his margins when selling gold.

You said nothing about short sellers and hedge funds selling enough MSTR short to push it down. This should be a very real concern. I’ve shorted stocks I felt were overvalued literally thousands of times over the years.

Former stock broker w/ ~20 yrs. at one company. Spoke with 100k+ people and traded a lot (long, short, options, margin, extended hours, etc.).

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

- Recyclersteve

- Too Busy Posting to Hoard Anything Else

- Posts: 4591

- Joined: Sun Jan 20, 2013 5:59 am

- Location: Where I Want To Be

Re: Hey Recyclersteve, MSTR of no interest to you?

I'm glad you were able to make a hefty profit. I want everyone on Realcent to prosper. However, given MSTR's massive BTC holdings, I expect it to go higher again. We just saw new highs in BTC at $99,390. With more companies and countries positioning to mine/buy more, I believe sellers will be harder to find.

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them... (Thomas Jefferson)

-

shinnosuke - Super Post Hoarder

- Posts: 3740

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

Recyclersteve wrote:shinnosuke wrote:"Peter Schiff

@PeterSchiff

The higher the price of $MSTR stock, the more shares @Saylor can sell. The more shares he sells, the more #Bitcoin he can buy. The more Bitcoin he buys, the higher the Bitcoin price rises. When the price of Bitcoin goes up, the share price of MSTR goes up more. When does it end?

11:00 AM · Nov 19, 2024"

Peter is sad because interest in BTC cuts into his margins when selling gold.

You said nothing about short sellers and hedge funds selling enough MSTR short to push it down. This should be a very real concern. I’ve shorted stocks I felt were overvalued literally thousands of times over the years.

Great. Like I said, I own zero MSTR and YOU are the stock guy. If you profit from your MSTR transactions, I don't expect you to pay me a commission...well, maybe something nice in my Christmas stocking.

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them... (Thomas Jefferson)

-

shinnosuke - Super Post Hoarder

- Posts: 3740

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

tdtwedt wrote:Saylor has a history of being a scammer...

SEC investigationIn March 2000, the U.S. Securities and Exchange Commission (SEC) brought charges against Saylor and two other MicroStrategy executives for the company's inaccurate reporting of financial results for the preceding two years.[25] In December 2000, Saylor settled with the SEC without admitting wrongdoing by paying $350,000 in penalties and a personal disgorgement of $8.3 million.[26][27][28] As a result of the restatement of results, the company's stock declined in value and Saylor's net worth fell by $6 billion.

https://en.wikipedia.org/wiki/Michael_J._Saylor

I can’t believe others haven’t brought this up recently. Yet another reason to be short.

Former stock broker w/ ~20 yrs. at one company. Spoke with 100k+ people and traded a lot (long, short, options, margin, extended hours, etc.).

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

- Recyclersteve

- Too Busy Posting to Hoard Anything Else

- Posts: 4591

- Joined: Sun Jan 20, 2013 5:59 am

- Location: Where I Want To Be

Re: Hey Recyclersteve, MSTR of no interest to you?

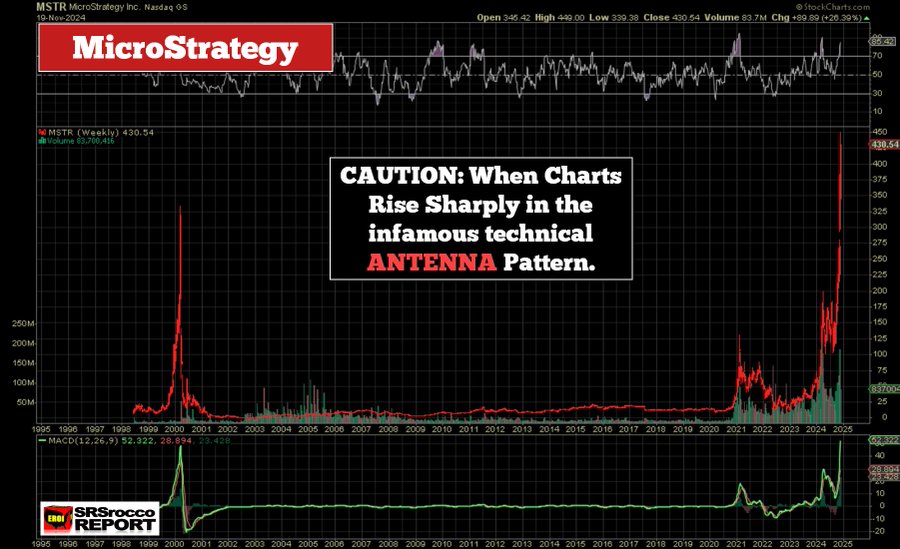

tdtwedt wrote:

Very interesting chart. I hope others see this and are thinking what I am- that MSTR is EXTREMELY OVERVALUED right now.

Former stock broker w/ ~20 yrs. at one company. Spoke with 100k+ people and traded a lot (long, short, options, margin, extended hours, etc.).

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

- Recyclersteve

- Too Busy Posting to Hoard Anything Else

- Posts: 4591

- Joined: Sun Jan 20, 2013 5:59 am

- Location: Where I Want To Be

Re: Hey Recyclersteve, MSTR of no interest to you?

Here's what's happening soon:

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them... (Thomas Jefferson)

-

shinnosuke - Super Post Hoarder

- Posts: 3740

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

Germans like MSTR

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them... (Thomas Jefferson)

-

shinnosuke - Super Post Hoarder

- Posts: 3740

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

53 posts

• Page 2 of 3 • 1, 2, 3

Return to Economic & Business News, Reports, and Predictions

Who is online

Users browsing this forum: No registered users and 9 guests