HALF of Americans don't pay income tax despite crippling government debt

151.7m people - 49.5% of the U.S. population - paid no federal income tax in 2009, figures show

By Daily Mail Reporter

UPDATED: 18:21 EST, 22 February 2012

Only half of U.S. citizens pay federal income tax, according to the latest available figures.

In 2009, just 50.5 per cent of Americans paid any income tax to the federal government - the lowest proportion in at least half a century.

And the number of people outside the tax system could have climbed even higher since as the economic downturn has continued to bite and unemployment has remained high.

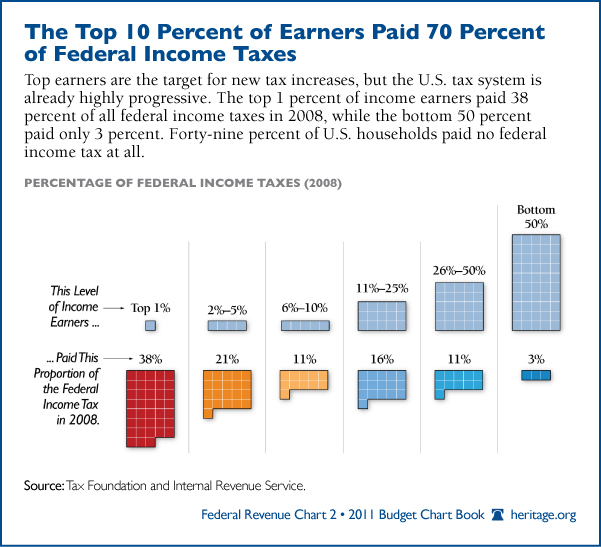

Figures: This graph from the Heritage Foundation shows that half the population of the U.S. pays no federal income tax at all

The decreasing number of taxpayers threatens government revenues, and could also cause resentment from those who believe that welfare recipients are taking money out of the economy.

151.7 million U.S. citizens paid no federal income tax in 2009, according to figures compiled by the Heritage Foundation, a right-wing think tank.

In 1984, the middle of the Reagan era, 85 per cent of Americans paid federal income tax, meaning just 34.8 million people did not.

More...Obama to CUT corporate tax to 28% and set even lower rate for manufacturers

'There are forces of evil in the world': Santorum defends his Satan warning... by comparing himself to Reagan

Ten things to watch for in the GOP debate - including Santorum's religion talk, Romney attacking and anyone sounding presidential

The figures include children, the retired and others who do not participate in the labor force.

Nonetheless, they largely reflect the sudden jump in the unemployment rate after the 2008 financial crisis and subsequent recession.

Unemployment rose from around five per cent at the beginning of 2008 to a high of 10 per cent in October 2009.

Crisis: Unemployment has declined slowly under Barack Obama

As well the increased number of jobless people, the reduction in the number of taxpayers is a result of low-income workers taking pay cuts and reduced hours, and therefore slipping out of the tax system.

It also includes people who illegally fail to file a tax return even though they might have earned enough money to do so.

Another finding by the Heritage Foundation shows that 21.8 per cent of U.S. citizens receive financial assistance from the federal government.

This means that 67.3 million people - a record high - are 'dependent on the federal government', excluding government employees who rely on the public sector for their salaries.

The conjunction of fewer taxpayers with higher welfare payments has led to intense pressure on the public purse, with the national deficit running at $1.3 trillion per year.

The Heritage Foundation argues that the reduction in the number of taxpayers will create an electorate dominated by non-taxpayers, who will always support higher taxes and spending because their own money is not at stake.

Read more: http://www.dailymail.co.uk/news/article ... z1sarwgjWz