Page 1 of 10

Hey Recyclersteve, MSTR of no interest to you?

Posted:

Mon Nov 11, 2024 4:45 pmby shinnosuke

Steve,

Would you mind doing a little research on

https://www.marketwatch.com/investing/s ... rch_symbol ? Let us know what you think.

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Mon Nov 11, 2024 5:02 pmby tdtwedt

MicroStrategy’s $42B BTC buy gives Ponzi schemes a bad nameSaylor’s hyperanimated optimism regarding BTC’s growth potential seems to ignore that he’s largely responsible for the gains that BTC has enjoyed this year. As one confirmed ‘gold bug’ put it, Saylor is the ‘Egg Man’ who doesn’t realize he’s practically BTC’s whole market.

https://coingeek.com/microstrategy-42b- ... -bad-name/

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Mon Nov 11, 2024 5:07 pmby tdtwedt

SEC investigationIn March 2000, the U.S. Securities and Exchange Commission (SEC) brought charges against Saylor and two other MicroStrategy executives for the company's inaccurate reporting of financial results for the preceding two years.[25] In December 2000, Saylor settled with the SEC without admitting wrongdoing by paying $350,000 in penalties and a personal disgorgement of $8.3 million.[26][27][28] As a result of the restatement of results, the company's stock declined in value and Saylor's net worth fell by $6 billion.

https://en.wikipedia.org/wiki/Michael_J._Saylor

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Mon Nov 11, 2024 11:31 pmby Recyclersteve

I’ll keep it real simple. How can you get anything out of bitcoin? I can melt down gold and silver. Companies sell real products and pay dividends.

I might eventually do something real small RE: MSTR or bitcoin (maybe $1,000 or less), but I realize it is a total gamble. I’m concerned that if I do a bit, I will want to do more and more. And it could be like drinking alcohol.

One more thing. Did you ever see how many thousands of cryptos have failed?

Risk/reward just doesn’t look good to me.

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Tue Nov 12, 2024 12:04 amby shinnosuke

If a company offers a service that can’t be melted down like gold, it’s worthless and you won’t buy its shares? A radio broadcaster, for example, sends out music, news, advertising, etc. You can’t melt radio waves, so you would limit your exposure to that company despite it being a prosperous enterprise?

BTC is decentralized and deflationary. That’s what you get out of it, among other things. It is strengthened by being constantly verified on the world’s most powerful computer network. And if you want to send someone some BTC, you don’t need permission from your banker or Uncle Sam.

Anyway, I’m not trying to convince you to buy or support BTC. You’re the stock guy around these parts so I wanted to see why you don’t find MSTR to be a compelling story.

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Tue Nov 12, 2024 5:19 amby Lemon Thrower

How many thousandss of railrooads, airlines, or internet companies failed?

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Tue Nov 12, 2024 6:03 amby Lemon Thrower

MSTR likely to get added to the QQQ, I would not short this one.

I wouldn't necessarily buy a such a high mNAV but I certainly would not shorrt.

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Tue Nov 12, 2024 7:43 amby tdtwedt

Peter Schiff today on MSTR...

MSTR borrows money and issues shares to buy more #Bitcoin. As a result, the price of Bitcoin goes up, which causes the price of $MSTR to increase, allowing it to borrow more money and sell more shares to buy even more Bitcoin. Wash, rinse, repeat—what could possibly go wrong?

https://x.com/PeterSchiff/status/1856316216085778545

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Thu Nov 14, 2024 5:10 pmby shinnosuke

https://www.youtube.com/live/TasvNr1gBGs1 hr 44 minutes of pure enlightenment. Microstrategy Q3 2024 Earnings Call

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Thu Nov 14, 2024 6:11 pmby tdtwedt

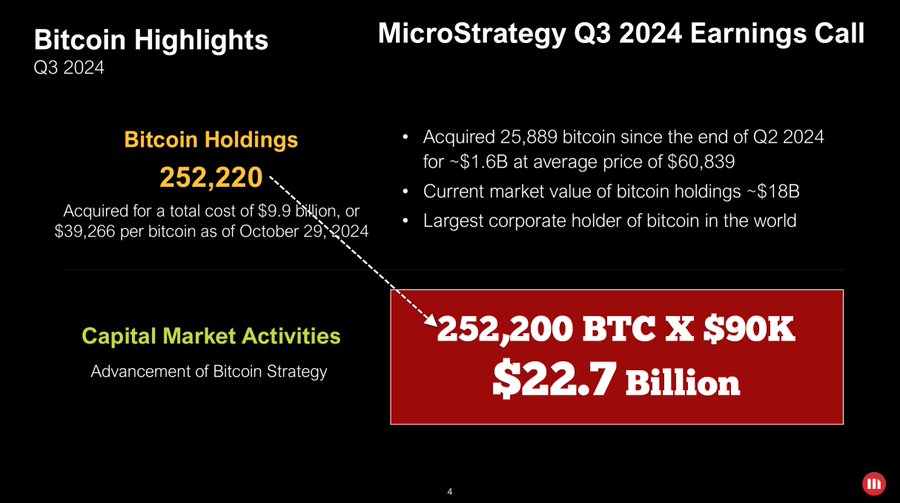

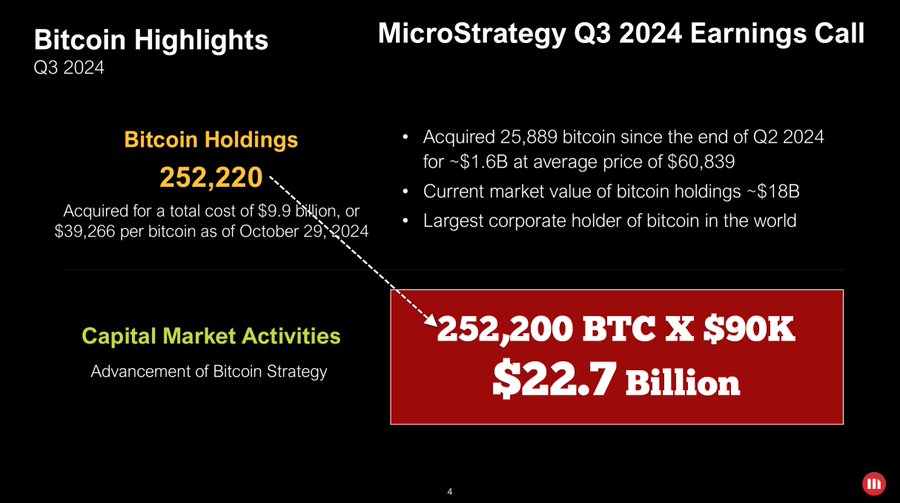

Unfortunately, MSTR is a PONZI on top of a PONZI.

MSTR current Market Cap = $66.4 billion

However, its total holdings as of Q3 2024 of 252,200 $BTC equates to only $22.7 billion based on $90K Bitcoin Price.

When the Bitcoin-Tether Ponzi POPS...

So will MSTR on leverage.

https://x.com/SRSroccoReport/status/1857168672391086090

https://x.com/SRSroccoReport/status/1857168672391086090

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Fri Nov 15, 2024 7:26 amby Lemon Thrower

Saylor says they will probably raise the $42B much quicker than 3 years.

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Mon Nov 18, 2024 10:40 amby shinnosuke

New announcement

Michael Saylor

@saylor

"MicroStrategy has acquired 51,780 BTC for ~$4.6 billion at ~$88,627 per #bitcoin and has achieved BTC Yield of 20.4% QTD and 41.8% YTD. As of 11/17/2024, we hodl 331,200 $BTC acquired for ~$16.5 billion at ~$49,874 per bitcoin. $MSTR" (end quote)

I don't own any MSTR and should have mentioned that fact earlier. I understand BTC. I own BTC.

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Mon Nov 18, 2024 10:43 amby tdtwedt

Peter Schiff on Saylor...

Michael Saylor is the Egg Man. His latest announcement is that $MSTR will spend another $42 billion to buy #Bitcoin, funded by issuing $21 billion in debt and $21 billion in equity over the next three years. This reminds me of a joke I heard a long time ago.

A client calls his broker inquiring about egg futures and is quoted a price of 25 cents per contract. Having a hunch about the egg market, he buys 100 contracts. A week later, he calls his broker to get a quote. Pleased to learn that the price per contract has risen to 35 cents, he decides to buy another 1,000 contracts. A few days later, eager to check on the progress of his investment, he is amazed to learn that the price has now risen to 50 cents per contract, twice the price he paid for his original 100 contracts. Sensing a trend, he steps it up, this time buying 100,000 contracts. The next day, ecstatic to learn that the price per contract has now risen to 65 cents, he gets even more aggressive, buying 1,000,000 contracts. Sure enough, the following day, the price per contract rises to 95 cents, prompting him to order an additional million contracts. The day after that, as rising prices further validate his intuition, he buys yet another million contracts, this time paying $1.25.

The next day, with egg contracts trading at $1.75, he senses that the market has risen too far too fast, and places an order to sell 2,000,000 contracts. After a pregnant pause, his broker replies, "Sell to whom, you're the egg man!"

https://x.com/PeterSchiff/status/1852004824973185363

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Mon Nov 18, 2024 12:57 pmby tdtwedt

Is retail back or is MicroStrategy only pumping the price of bitcoin?With the price of bitcoin pumping, many investors were hopeful that it would prove the return of retail investment. However, the influence of a single corporation on the relatively thin number of spot bitcoins listed for sale is casting doubt on this idea.

https://protos.com/is-retail-back-or-is ... f-bitcoin/

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Mon Nov 18, 2024 3:29 pmby tdtwedt

Peter Schiff today...

It's been less than three weeks since @Saylor announced a three-year plan for $MSTR to spent $42 billion buying #Bitcoin. So far, $6.63 billion has already been spent. At this rate the entire plan will be completed in under four months. Then Saylor is gonna need a bigger plan.

https://x.com/PeterSchiff/status/1858602445783658920

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Mon Nov 18, 2024 10:26 pmby shinnosuke

This is a tweet by British Hold and it's about BlackRock, not MSTR. MSTR has even more BTC than BlackRock. Let that sink in. But yeah, the derivatives are ruled by BlackRock.

BRITISH HODL

@BritishHodl

BlackRock owns and has exposure to the following verticals to attack the total addressable capital for #Bitcoin:

This is a post to bookmark and come back to so you can see how long this reach of BlackRock is in 12 months.

- ETF - with IBIT.

- Custody - with Coinbase.

- Acquiring - with Coinbase.

- Mining - with all the miners.

- Lending - with Cantor.

- Derivatives - with Options on IBIT.

- Bond Market - with MSTR TINA.

This represents 4 capital liquidity pools: Equities at $46 Trillion, Commodities at $53 Trillion, Bond Market at $46 Trillion and Options/Derivatives at $580 Trillion a year.

Total capital pool of roughly $725 Trillion now has direct access to #Bitcoin exposure because of BlackRock and Larry Fink.

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Tue Nov 19, 2024 12:02 amby shinnosuke

The Bitcoin Historian

@pete_rizzo_

HISTORY: MicroStrategy bought $4.6 BILLION worth of #Bitcoin today

The largest-ever purchase of $BTC in a single day. RIP bears.

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Tue Nov 19, 2024 7:07 amby tdtwedt

Peter Schiff today...

Now @saylor insists that #Bitcoin is digital energy. It's no more digital energy than it is digital #gold. If you own Bitcoin, how exactly do you use it to generate power? He said that taking away crude oil would cause mass starvation. Well, what would taking away Bitcoin cause?

https://x.com/PeterSchiff/status/1858833469876367560

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Tue Nov 19, 2024 12:35 pmby shinnosuke

The market likes MicroStrategy owning more BTC.

- MSTR Moving.png (91.52 KiB) Viewed 24659 times

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Tue Nov 19, 2024 12:41 pmby tdtwedt

Peter Schiff on MSTR...

The higher the price of $MSTR stock, the more shares @Saylor can sell. The more shares he sells, the more #Bitcoin he can buy. The more Bitcoin he buys, the higher the Bitcoin price rises. When the price of Bitcoin goes up, the share price of MSTR goes up more. When does it end?

https://x.com/PeterSchiff/status/1858918277931577839

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Tue Nov 19, 2024 1:02 pmby shinnosuke

"Peter Schiff

@PeterSchiff

The higher the price of $MSTR stock, the more shares @Saylor can sell. The more shares he sells, the more #Bitcoin he can buy. The more Bitcoin he buys, the higher the Bitcoin price rises. When the price of Bitcoin goes up, the share price of MSTR goes up more. When does it end?

11:00 AM · Nov 19, 2024"

Peter is sad because interest in BTC cuts into his margins when selling gold.

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Tue Nov 19, 2024 1:05 pmby tdtwedt

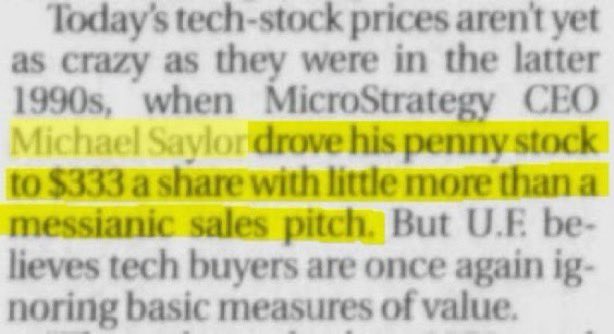

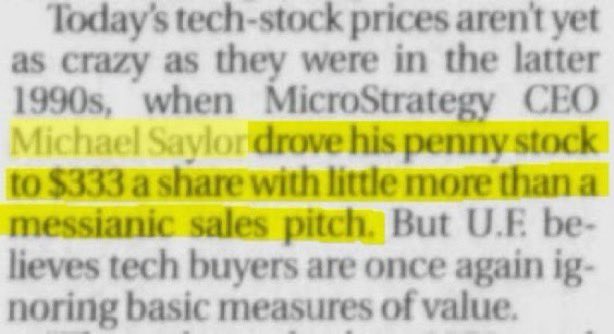

Saylor has a history of being a scammer...

SEC investigationIn March 2000, the U.S. Securities and Exchange Commission (SEC) brought charges against Saylor and two other MicroStrategy executives for the company's inaccurate reporting of financial results for the preceding two years.[25] In December 2000, Saylor settled with the SEC without admitting wrongdoing by paying $350,000 in penalties and a personal disgorgement of $8.3 million.[26][27][28] As a result of the restatement of results, the company's stock declined in value and Saylor's net worth fell by $6 billion.

https://en.wikipedia.org/wiki/Michael_J._Saylor

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Tue Nov 19, 2024 1:09 pmby tdtwedt

Do you think Michael Saylor still does this?

(2003ish article from here in Chicago I found)

https://x.com/BankerWeimar/status/1858675752268353610

https://x.com/BankerWeimar/status/1858675752268353610

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Wed Nov 20, 2024 2:54 amby Recyclersteve

Believe it or not, I just SHORTED a very small amount of Microstrategy (MSTR) today. Yes, I realize this could keep running before it pulls back.

I’ve sold short literally THOUSANDS of times and I fully expect a potentially wild ride.

As a means of comparison I once shorted Intuitive Machines (LUNR) in Feb. 2023.

I shorted it at $40.56. It went up to a whopping $136.00 at which point I was down about $9,500 on just 100 shares of stock. The very day after it hit $136.00, I closed out my short sale at $19.56 and almost doubled my money in just 8 days.

For anyone who wonders why I didn’t short it at a price around $136, you need to realize there were likely NO SHARES AVAILABLE to short (you have to borrow shares to sell short) at that time.

I never was in danger of getting wiped out, but I imagine some traders were hurt badly.

Re: Hey Recyclersteve, MSTR of no interest to you?

Posted:

Wed Nov 20, 2024 6:06 amby Lemon Thrower

Steve, I can understand why you shorted it. Its business model shouldn't make sense. Its trading at 3x its NAV and it already has a third of a million Bitcoin. Even raising $42B its going to be tough to source the full million bitcoin to justify its current price. Still, its about to be added to the QQQ and is the best performing stock among the SP500. I hope you have hedged your downside with options. This is like bending down to pick up pennies in front of a steam roller with rocket engines. Best of luck to you but I fear you will get your face ripped off on this one.

You remind me of a quote attributed to Jim Dines - "Every gambler has a secret desire to lose."