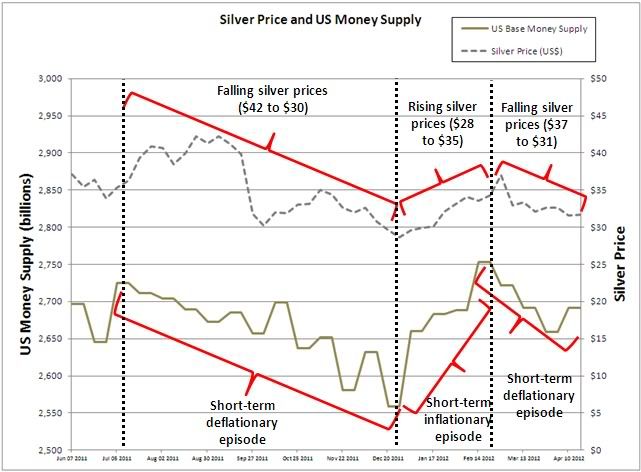

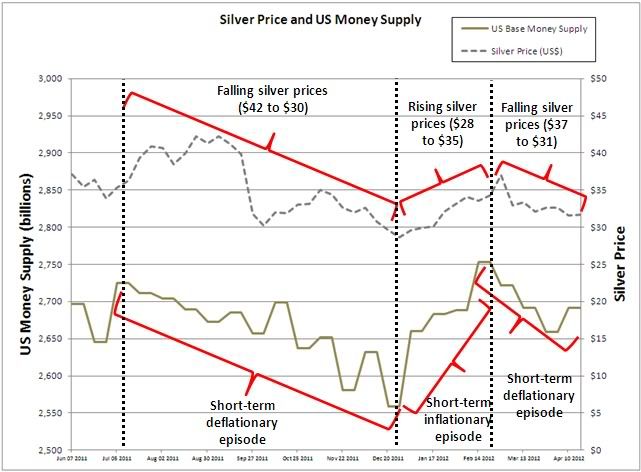

This suggests that any hint of further money injections from the Fed is bullish for silver. You can follow the US money supply figures published biweekly at http://research.stlouisfed.org/fred2/series/BASE.

68Camaro wrote:Interesting graph. I would be more interested in it if it tracked for years instead of months, or it correlated with other types of money supply. The larger measure of money supply continues to increase - especially government spending, which isn't tracked here - though at the private consumer level it may well be locally decreasing.

Return to Silver Bullion, Gold, & other Bullion Metals

Users browsing this forum: No registered users and 3 guests