Page 1 of 1

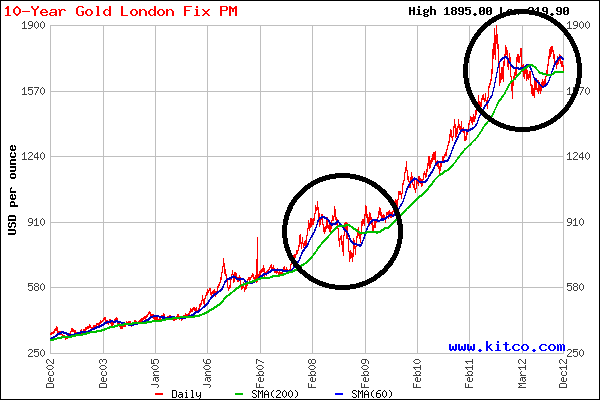

Gold 200 Day Moving Avg.

Posted:

Wed Dec 19, 2012 11:59 pmby johnbrickner

Will gold push down through the 200 day moving avg.?

Re: Gold 200 Day Moving Avg.

Posted:

Thu Dec 20, 2012 4:44 amby Market Harmony

johnbrickner wrote:Will gold push down through the 200 day moving avg.?

I don't know if it will stay below it for very long, if it will break through the 200 dma and continue down, or touch and rebound off of it like it has statistically done over and over again since the bull run began. Here's a chart of GLD with a 200 dma line added to show what I mean.

Re: Gold 200 Day Moving Avg.

Posted:

Thu Dec 20, 2012 8:18 amby beauanderos

johnbrickner wrote:Will gold push down through the 200 day moving avg.?

If it does... statistically it's a better time to buy than when it's stretched above the line

Re: Gold 200 Day Moving Avg.

Posted:

Thu Dec 20, 2012 8:29 amby Rodebaugh

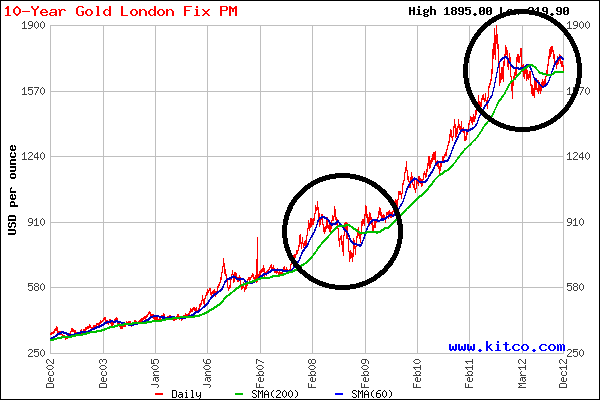

Charty from Kitco.

Looks like a bounce off followed by a heavy bull. Seeing how thats what It looks like....expect multi year lows in the comingf months.

Please do not use my thoughts as a buy or sell indicator.....just rambelings from a no nothing dude.

Re: Gold 200 Day Moving Avg.

Posted:

Thu Dec 20, 2012 8:48 amby silverflake

Rodebaugh, good charts, good questions. But your second chart with the circled regions is what excites me. We are in a strength forming consolidation. I feel we are winding up like a spring being coiled to unleash itself. The longer we consolidate, the more strength we build. The longer we string out, the more weak hands will give up. Stay long my friends.

Just saying.

Keep stacking!

Re: Gold 200 Day Moving Avg.

Posted:

Thu Dec 20, 2012 12:22 pmby rawteam1

1st time since august under the 200...

will be interesting to c how long it lasts...

it is the sign that its time to buy phyzz though...

Re: Gold 200 Day Moving Avg.

Posted:

Sat Jan 19, 2013 10:56 pmby johnbrickner

Here we are a month later. Feels like it was a good time to have bought as gold took a bounce back up and is now up against the 30 dMA with the 14 dma turned up nicely.

Friday's PMs prices found gold and the Other white metals soften very lightly, while silver did not.

Question now is up and thru the 30 DMA to next level of resistance or ?

Price doesn't seem like it's high enough to have an entity with the power and leverage to crash it down a bit. The general public seems to be in a more buying mode of assets with staying power since the election, talk of the trillion dollar coin, recent gun control measures, and talk of internation currency devaluation wars.

Seems like technical and fundamental are favorable for continued moves up, perhaps with bumps in the road as usual.

Or so it looks to me