Trading/Investment Thread

Re: Trading/Investment Thread

What law said they had to be balanced it just exposes that ETFs are scam investment vehicles designed to pilfer you out of your money. In the graph shown it shows a short term fully hedged position would have shown around a net 25% loss.

- silverhalide

- Posts: 15

- Joined: Mon Nov 01, 2010 1:09 pm

Re: Trading/Investment Thread

Thus the interest in it...

In the game of Woke, the goal posts can be moved at any moment, the penalties will apply retroactively and claims of fairness will always lose out to the perpetual right to claim offense.... Bret Stephens

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

-

68Camaro - Too Busy Posting to Hoard Anything Else

- Posts: 8638

- Joined: Thu Dec 30, 2010 6:12 am

- Location: Disney World

Re: Trading/Investment Thread

Since there is a daily reset, time is a factor in amplitude, not merely direction. This is why I like AGQ. For someone who believes that, over the long term, silver will rise, this vehicle delivers more than double leverage. That is, when silver is manipulated, it tends to dive dramatically during a rapid time frame, but during recovery will usually require several times longer to return to former highs. If it does so over the course of trading days that deliver many small upside days in comparison to few large down days, then AGQ, because of the daily reset, will distort this effect in the favor of the long holder. What that chart shows is that silver consistently had more up days than down, thus the end points are not equidistant from the baseline. Other than that, they appear to be mostly mirror images. One other factor is the difficulty of emulating the physical price with a paper derivatives device. When dramatic price changes occur near the end of the day, these may not always be perfectly reflected in the last minute algorithmic adjustments. Trying to track, for instance, a $6 drop in a ten minute period was probably a nightmare, and may have produced an estimate rather than ultra-reliable accuracy during that particular event. AGQ is not for the faint of heart, and if you employ tight stops you will get whipsawed out of your positions due to the magnitude of volatility this ETF entails. It is not for those with a low risk tolerance, and might best be used only by those who already have a reliable physical store of PM's and are just looking for that last ummmph of performance to wring out of their investments, utilizing, at best, only a small position of their overall portfolio.

The Hand of God moves Worlds

-

beauanderos - Too Busy Posting to Hoard Anything Else

- Posts: 9827

- Joined: Wed Oct 14, 2009 10:00 am

Re: Trading/Investment Thread

Anyone have thoughts on gold royalty companies like Franco-Nevada and Tanzanian Royalty? The first is run by Pierre Lassonde (sp?) and the second by Jim Sinclair. Both of them give interviews on King World News from time to time. The way I understand it, the advantage is that, as royalty companies, they aren't 100% invested in a single property and don't deal with many of the issues that mining companies do. Instead, they simple get royalties off whatever comes out of the ground at a range of different mines and so they theorhetically always have some cash flow and can benefit from a rising gold price. Franco-Nevada is already paying dividends, while Tanzanian is currently losing a couple cents per share. Basically they just go around and buy rights to a certain percentage of the gold that comes from different mines. Like a 30% stake in XYZ, a 15% stake in ABC, etc.

And he that hath lyberte ought to kepe hit wel

For nothyng is better than lyberte

For lyberte shold not be wel sold for alle the gold and syluer of all the world

-Aesop's Fables, Caxton edition 1484

For nothyng is better than lyberte

For lyberte shold not be wel sold for alle the gold and syluer of all the world

-Aesop's Fables, Caxton edition 1484

-

AGgressive Metal - Realcent Moderator

- Posts: 5931

- Joined: Sat Dec 13, 2008 10:00 am

- Location: Portland

Re: Trading/Investment Thread

68Camaro wrote:Put in sell limit bids for PSLV at 18 and 18.6

[Back from vacation]

Had modified these to 17.25 and 18. Sold first set last week, and just squeaked by on the second yesterday morning at open before the latest slide started... So I've worked the JPM pump once. Now to see if it can be done again.

In the game of Woke, the goal posts can be moved at any moment, the penalties will apply retroactively and claims of fairness will always lose out to the perpetual right to claim offense.... Bret Stephens

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

-

68Camaro - Too Busy Posting to Hoard Anything Else

- Posts: 8638

- Joined: Thu Dec 30, 2010 6:12 am

- Location: Disney World

Re: Trading/Investment Thread

Long OMNOVA (OMN)

"OMNOVA Solutions Inc. (OMNOVA) is a provider of emulsion polymers, specialty chemicals and decorative and functional surfaces for a range of commercial, industrial and residential end uses. OMNOVA operates in two business segments: Performance Chemicals and Decorative Products. During the fiscal year ended November 30, 2010 (fiscal 2010), the Company’s Performance Chemicals and Decorative Products segment’s net sales were 62% and 38%, respectively. In May 2010, OMNOVA acquired The Dow Chemical Company's hollow sphere plastic pigment (HPP) product line and terminated the RohmNova paper coatings joint venture. On December 9, 2010, the Company acquired Eliokem International SAS (Eliokem) from AXA Investment Managers Private Equity Europe and the other holders of Eliokem. The Company uses 16 manufacturing, technical and other facilities located in North America, Europe and Asia to service its customer base."

"OMNOVA Solutions Inc. (OMNOVA) is a provider of emulsion polymers, specialty chemicals and decorative and functional surfaces for a range of commercial, industrial and residential end uses. OMNOVA operates in two business segments: Performance Chemicals and Decorative Products. During the fiscal year ended November 30, 2010 (fiscal 2010), the Company’s Performance Chemicals and Decorative Products segment’s net sales were 62% and 38%, respectively. In May 2010, OMNOVA acquired The Dow Chemical Company's hollow sphere plastic pigment (HPP) product line and terminated the RohmNova paper coatings joint venture. On December 9, 2010, the Company acquired Eliokem International SAS (Eliokem) from AXA Investment Managers Private Equity Europe and the other holders of Eliokem. The Company uses 16 manufacturing, technical and other facilities located in North America, Europe and Asia to service its customer base."

Most people do not consider dawn to be an attractive experience - unless they are still awake.

-

DeanStockwell - Penny Pincher Member

- Posts: 138

- Joined: Mon Jan 03, 2011 5:33 am

- Location: Far, Far away...

Re: Trading/Investment Thread

long souther copper scco pays 7% dividend hold as long as they pay

- moneydog

- Penny Pincher Member

- Posts: 124

- Joined: Tue Apr 26, 2011 12:17 am

Re: Trading/Investment Thread

matt badiali has an 89 dollar newsletter that it well worth it and he analyzes the value of Royal Gold. he doesn't cover FN or TRE. the royalty model is sound but that doesn't mean the stock will ever move and some of these companies have royalty streams that won't be in the money for years.

Smoke 'em if you've got 'em!

-

Lemon Thrower - Too Busy Posting to Hoard Anything Else

- Posts: 4136

- Joined: Fri Jun 13, 2008 10:00 am

Re: Trading/Investment Thread

DeanStockwell wrote:Out of SSW. -DI crossed over the +DI, bearish sign. Sold for only a small loss. Also out of SIX.

LONG

BRO

MMS-Took SSW money and filled a second allocation at 78.92. This is a very nice chart.

Six flags posted huge gains. I was reading in a local paper. May have jumped soon.

Ancora Imparo

"You can't control the wind, but you can adjust your sails."

-Albert Einstein

"You can't control the wind, but you can adjust your sails."

-Albert Einstein

-

John_doe - Post Hoarder

- Posts: 2502

- Joined: Sat Apr 02, 2011 10:38 pm

Re: Trading/Investment Thread

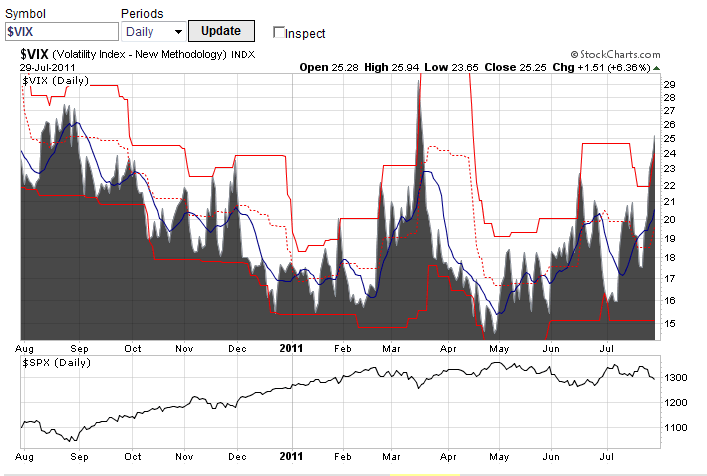

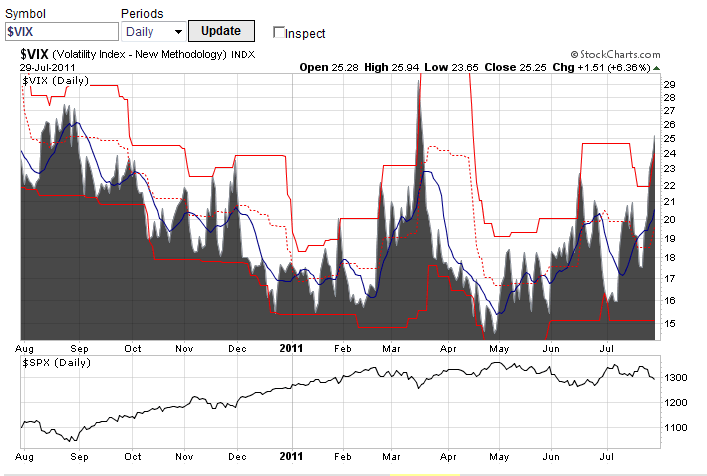

It's been awhile since I posted in this thread. Right now I'm short volatility with the etf XIV, the daily inverse of the .VIX. Got in at $16. I think the debt ceiling-fueled decline last week was overblown and we are going to see a broad rally this week when we get a deal from congress sometime soon.

If you look at this chart, the .VIX (Volatility Index), when it hits the upper price channel, usually corrects sharply and reverts back to a "normal" level.

The .VIX moves inversely to the markets.

Looking back, when the .VIX hits the upper price channel, this signals that markets are oversold and we have usually seen a significant rally. Granted, the situation is a bit more sticky now with the debt ceiling, but I feel that history will repeat itself and we will see a fall in volatility this week.

Based on this, I would reccomend against ETF's which are long volatility, such as VXX and TVIX(Leveraged), and load up on short volatility ETF's like XIV. Also buy ETF's which are long on markets such as IWM(Unleveraged) and TNA(3x leverage).

If you look at this chart, the .VIX (Volatility Index), when it hits the upper price channel, usually corrects sharply and reverts back to a "normal" level.

The .VIX moves inversely to the markets.

Looking back, when the .VIX hits the upper price channel, this signals that markets are oversold and we have usually seen a significant rally. Granted, the situation is a bit more sticky now with the debt ceiling, but I feel that history will repeat itself and we will see a fall in volatility this week.

Based on this, I would reccomend against ETF's which are long volatility, such as VXX and TVIX(Leveraged), and load up on short volatility ETF's like XIV. Also buy ETF's which are long on markets such as IWM(Unleveraged) and TNA(3x leverage).

Most people do not consider dawn to be an attractive experience - unless they are still awake.

-

DeanStockwell - Penny Pincher Member

- Posts: 138

- Joined: Mon Jan 03, 2011 5:33 am

- Location: Far, Far away...

Re: Trading/Investment Thread

Dow Futures up 170...

XIV Limit set at 16.96, XIV stop at 15.62.

XIV Limit set at 16.96, XIV stop at 15.62.

Most people do not consider dawn to be an attractive experience - unless they are still awake.

-

DeanStockwell - Penny Pincher Member

- Posts: 138

- Joined: Mon Jan 03, 2011 5:33 am

- Location: Far, Far away...

Re: Trading/Investment Thread

DeanStockwell wrote:Dow Futures up 170...

XIV Limit set at 16.96, XIV stop at 15.62.

The Nikkei is up almost 2% now on news of the debt ceiling compromise. Michele Bachmann, bless her heart, says she will vote against it.

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4290

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Trading/Investment Thread

Double XIV Position at 16.08

Most people do not consider dawn to be an attractive experience - unless they are still awake.

-

DeanStockwell - Penny Pincher Member

- Posts: 138

- Joined: Mon Jan 03, 2011 5:33 am

- Location: Far, Far away...

Re: Trading/Investment Thread

Still holding XIV, bought very large position of TNA at 63.14, equal to the size of XIV position. Betting the farm, 75% of my portfolio is deployed in XIV and TNA...time will tell

Most people do not consider dawn to be an attractive experience - unless they are still awake.

-

DeanStockwell - Penny Pincher Member

- Posts: 138

- Joined: Mon Jan 03, 2011 5:33 am

- Location: Far, Far away...

Re: Trading/Investment Thread

Dean, so what do you think about silver? Here is a chart of mine I marked up thinking after the debt cieling was raised price action would retract but to my

Is this any better?

Last edited by slow to learn on Thu Aug 04, 2011 1:06 am, edited 1 time in total.

- slow to learn

- Posts: 18

- Joined: Sun Jul 31, 2011 11:06 pm

Re: Trading/Investment Thread

First try here posting a chart, I have to get used to this forum so you can make out my charts sorry. Ill work on it!

- slow to learn

- Posts: 18

- Joined: Sun Jul 31, 2011 11:06 pm

Re: Trading/Investment Thread

Market Harmony wrote:Junior Miners are very cheap at the moment.

If you would like for me to share a stock pick with you that I have taken on a position, then please PM me. I'm not going to publicly state the stock. It is considered a "penny stock" as it currently trades under $1. But, it trades on the AMEX, not the OTCBB or Pink Sheets. Resource reports, based on many core drilling samples, indicate a silver and zinc ore body worth well over $1 billion, and the current market cap is only $84 million. Current price reflects the status of the mine... undeveloped and in the discovery phase. You can lose all of your investment in this company, but the potential return over the next few years is outstanding.

The reply from me will be only a stock ticker symbol. Due diligence is your responsibility.

For those of you that contacted me, I have added to my position.

Brick and mortar shop: buy, sell, and trade anything precious- coins, bullion, scrap, jewelry, gems, etc.

http://marketharmony.net

Follow me on Twitter- @MarketHarmony

http://marketharmony.net

Follow me on Twitter- @MarketHarmony

-

Market Harmony - Super Post Hoarder

- Posts: 3256

- Joined: Fri Feb 13, 2009 3:00 pm

- Location: 657 Evergreen Ave, First Floor, Pittsburgh, PA 15209

Re: Trading/Investment Thread

Well... I got spanked today, for shame, for shame  Had a thousand to burn in my self-directed 401k, so I'm looking at NUGT (double GDX). Had enough to buy 30 shares at market, but in between the time I placed a limit buy order and hitting the key it ran up a bit out of reach. So I'm thinking, "Heck... it'll come back to me, it's only ten cents, and trigger my order."

Had a thousand to burn in my self-directed 401k, so I'm looking at NUGT (double GDX). Had enough to buy 30 shares at market, but in between the time I placed a limit buy order and hitting the key it ran up a bit out of reach. So I'm thinking, "Heck... it'll come back to me, it's only ten cents, and trigger my order."

Freakin danged sucker ran up almost $2 a share today (5.52%). Aaaarghhh!

Freakin danged sucker ran up almost $2 a share today (5.52%). Aaaarghhh!

The Hand of God moves Worlds

-

beauanderos - Too Busy Posting to Hoard Anything Else

- Posts: 9827

- Joined: Wed Oct 14, 2009 10:00 am

Re: Trading/Investment Thread

Todays buys:

SDS - 9:03:00

Bought 100s @ $25.00 - Total: $2,382.00

SDS - 10:00:29

Bought 80s @ $25.73 - Total: $2,065.40

SDS - 9:03:00

Bought 100s @ $25.00 - Total: $2,382.00

SDS - 10:00:29

Bought 80s @ $25.73 - Total: $2,065.40

This space for rent.

-

Rodebaugh - Realcent Moderator

- Posts: 7959

- Joined: Fri Aug 14, 2009 3:00 pm

Re: Trading/Investment Thread

Todays picks:

SDS......looks like we are going further down so why not (short term)-day/hours

AA.......If you can get it below 11, I say go for it (medium term)-week/days

GOOG...I like this one below 475, Co has a ton of cash (medium long term)-weeks/3 months

MO......I like MO at sub 25, great divi, strong balace sheet (long term) - years/year

SDS......looks like we are going further down so why not (short term)-day/hours

AA.......If you can get it below 11, I say go for it (medium term)-week/days

GOOG...I like this one below 475, Co has a ton of cash (medium long term)-weeks/3 months

MO......I like MO at sub 25, great divi, strong balace sheet (long term) - years/year

This space for rent.

-

Rodebaugh - Realcent Moderator

- Posts: 7959

- Joined: Fri Aug 14, 2009 3:00 pm

Re: Trading/Investment Thread

Funny...I sold my stake in PSLV Friday for $3 profit a share....thinking crashing on monday...WRONG up $0.46 so far this morning...Maybe this afternoon.

-

fasteddy - Post Hoarder

- Posts: 2673

- Joined: Wed Sep 02, 2009 10:00 am

Re: Trading/Investment Thread

TBT options are finally getting cheaper

Brick and mortar shop: buy, sell, and trade anything precious- coins, bullion, scrap, jewelry, gems, etc.

http://marketharmony.net

Follow me on Twitter- @MarketHarmony

http://marketharmony.net

Follow me on Twitter- @MarketHarmony

-

Market Harmony - Super Post Hoarder

- Posts: 3256

- Joined: Fri Feb 13, 2009 3:00 pm

- Location: 657 Evergreen Ave, First Floor, Pittsburgh, PA 15209

Re: Trading/Investment Thread

Talk about a loss of Jobs....Look for this to be heavily oversold........I'm Buying AAPL with both hands

This space for rent.

-

Rodebaugh - Realcent Moderator

- Posts: 7959

- Joined: Fri Aug 14, 2009 3:00 pm

Re: Trading/Investment Thread

I was like... what the *heck* is he talking about...

Finally just saw the headline.

So you think this is a good thing? Job leaving i mean. Why else would you buy it after he announces his resignation?

Finally just saw the headline.

So you think this is a good thing? Job leaving i mean. Why else would you buy it after he announces his resignation?

Rodebaugh wrote:Talk about a loss of Jobs....Look for this to be heavily oversold........I'm Buying AAPL with both hands

In the game of Woke, the goal posts can be moved at any moment, the penalties will apply retroactively and claims of fairness will always lose out to the perpetual right to claim offense.... Bret Stephens

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

-

68Camaro - Too Busy Posting to Hoard Anything Else

- Posts: 8638

- Joined: Thu Dec 30, 2010 6:12 am

- Location: Disney World

Return to Economic & Business News, Reports, and Predictions

Who is online

Users browsing this forum: No registered users and 1 guest