The mystery of what happened to millions of dollars’ worth of gold and silver bullion that vanished from a downtown Austin vault 2½ years ago just got a little less puzzling.

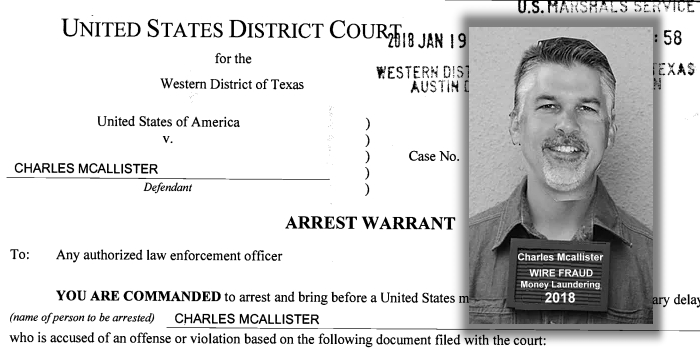

On Tuesday, federal prosecutors arrested Charles McAllister, the founder and former majority owner of Bullion Direct, charging him with three felony counts of fraud and misusing money customers gave him to buy gold, silver and platinum on their behalf.

The indictment also said the government would seek more than $16 million from McAllister under U.S. criminal forfeiture statutes. In civil court filings, Bullion Direct’s customers have placed the value of their disappeared money and metal at $25 million.

[...]

In documents filed in U.S. District Court that were unsealed late Tuesday, federal prosecutors alleged that instead of buying the precious metals ordered by Bullion Direct’s customers, McAllister used their money to keep the business afloat, and for himself.

[...]

Dealers said Bullion Direct started off as a reputable company, paying on time and in full. For 15 years, Bullion Direct’s public face was one of success. Buyers and sellers said their orders were processed without a hitch. Those who requested delivery of gold and silver received it on time.

[...]

Behind the scenes, however, the company was foundering. One attorney later described it as “a slow-motion Ponzi-like scheme.”

Auditors later discovered Bullion Direct had filed only a single tax return. In 2009, it was carrying $17 million in losses. Yet McAllister paid himself hundreds of thousands of dollars in salary.

Bullion Direct declared bankruptcy on July 20, 2015. While some customers received email notification of the filing, others said they learned about it only after logging onto Bullion Direct’s website and finding a message that said the company was insolvent.

[...]

A year later, in what officials acknowledged was an unusual arrangement, what remained of the company — primarily proprietary software — was purchased by McAllister’s mother. She agreed to turn over most future profits from the new venture, Platform Universe, which does business under the name Bullion Universe, to her son’s more than 500 creditors.

Although Bullion Direct’s restructuring attorney at the time said the trading platform forming the basis for Platform Universe would be a viable business, creditors said the company has yet to generate any profits for them.

http://www.mystatesman.com/news/crime-- ... rBqBADh1O/