Here is the link so you can look at all the cool graphs within the article: https://www.barrons.com/articles/qualco ... 1541709683

I know there are some Realcent folks who do not "do" externals links, so I copied and pasted the article, but could not include the graphics which make up about a third of the article:

Gold Is Cheap. Inflation Is Coming. You Do the Math

By Andrew Bary

Updated Sept. 24, 2018 1:05 p.m. ET

Gold Is Cheap. Inflation Is Coming. You Do the Math

Jonathan Bartlett

Text size

Gold has gotten a bad rap.

Long seen as the investment choice of the cranky and the fearful, the metal yields nothing; as Warren Buffett has said, it just “looks at you.”

This year has been especially lackluster for gold. Its price has slumped 8%, to about $1,200 an ounce, and is off more than 35% from its high of $1,900 in 2011. Adding insult to injury, Vanguard will soon rechristen the largest gold-oriented U.S. mutual fund and shift its focus away from the metal.

But this out-of-favor asset class now deserves a place in investment portfolios.

Compared with stocks and other financial assets, gold looks inexpensive. More important, inflation is starting to pick up in the U.S. and in much of the world as central banks shrink their enormous balance sheets. And gold has represented a good defense against inflation eroding the value of a stock or bond portfolio. Over time, it has held its value against the dollar. Gold was $20.67 an ounce 100 years ago and that bought a good men’s suit. At $1,200 an ounce, the same is true today.

“Gold is rare, and it’s hard to rapidly increase the supply of it,” says Keith Trauner, co-portfolio manager of the GoodHaven (ticker: GOODX) mutual fund, which holds Barrick Gold (ABX), a leading mining company. “People have historically viewed it as a hedge against government depreciation of local currency.”

There are an estimated six billion ounces of gold in the world, worth more than $7 trillion, about 30% of the value of the S&P 500. Annual new mined supply adds less than 2% to the global total.

Read the Sidebar

“Virtually every government in the world is trying to promote inflation partly because there is so much sovereign debt,” Trauner says. When there is so much debt, he contends, governments have three choices: default, restructure, or inflate the currency. “Politicians, when given the chance, will choose the latter.”

Naysayers point to higher interest rates as a negative for gold because it increases the allure of holding cash. But gold had one of its best decades during the inflationary 1970s, when rates soared.

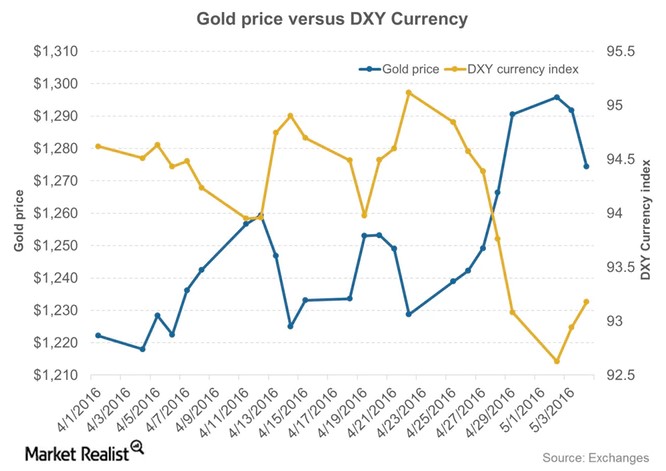

One catalyst that could change investor sentiment on gold is a decline in the U.S. dollar.

“Gold is the anti-dollar,” says Pierre Lassonde, the chairman and a co-founder of Franco-Nevada (FNV), a gold and mining royalty company with an $12 billion stock market value. “When the dollar is strong, there is no need for gold. But when the dollar is weak, people go back to gold.”

Historically, gold and the dollar have a negative correlation of 80% to 85%. The dollar has been supported by expectations that the Federal Reserve will keep tightening and lift its benchmark, the federal-funds rate, to 2.5%-3%, from the current range of 1.75% to 2% by the end of 2019.

Trey Reik, a metals strategist at Sprott USA, says the Fed may have to relent, in part because the upward pressure on rates is squeezing developing economies that have dollar-denominated bonds or other obligations. If the markets sense that the Fed is about to hold off, the dollar could drop and gold would probably rally. His view is that “gold offers enormous portfolio utility in today’s complex and treacherous investment environment.”

Currently, many U.S. investors own little or no gold, but there are a few prominent bulls on the metal. One is Jeffrey Gundlach, the outspoken and often prescient CEO of DoubleLine Capital, the big bond-oriented investment firm.

“In my June webcast, I recommended that gold bugs wait until $1,200 to buy because it had just broken below” a chart point at $1,290, Gundlach wrote in an email to Barron’s. He turned positive early this month when gold hit $1,196. Based on the technicals, “I am now bullish,” he concluded.

Gold has been a traditional hedge against financial and economic crises, playing that role during the 2008-09 meltdown. Gold rallied 17% from the collapse of Lehman Brothers on Sept. 15, 2008, until the stock market bottomed on March 9, 2009—a period during which the S&P 500 fell more than 40%.

Cryptocurrencies have lately been touted as taking over gold’s role in a crisis. But a 55% drop in Bitcoin this year to about $6,700, and slumps in other cryptocurrencies, have taken the shine off that market. And there is still no easy way to get exposure to Bitcoin.

In comparison, gold has had allure as a store of value and measure of wealth for thousands of years. And gold remains so in much of the world, including China and India. Before the 1930s, it was used as money in U.S.

How cheap is gold today?

One way to measure it against stocks is a comparison with the Dow Jones Industrial Average. It effectively takes 22 ounces of gold to buy one unit of the Dow, which finished on Friday at a record 26,743. The most recent low in that relationship occurred in 2011, when the Dow/gold ratio dropped to 7.8. Then, gold was near its all-time high of $1,900 an ounce.

The century-old peak of 40 occurred in 1999, when gold traded at about $290 an ounce and the Dow stood around 11,500. The low came at the top of the commodity boom in 1980, when the metal and the Dow were at parity around 800 after a decade-long stretch when the Dow moved little. Commodities overall are historically cheap versus stocks.

In the futures markets, speculators, who are normally long gold, are now in the rare position of being net short. Many analysts view speculative positions as a contrary indicator and the current situation as bullish.

The knocks against gold are many. It’s a static asset that yields nothing, and physical gold costs money to store. Berkshire Hathaway CEO Buffett says he would rather own productive assets like businesses, farms, or stocks. “Gold gets dug out of the ground in Africa or someplace,” he noted 20 years ago. “Then we melt it down, dig another hole, bury it again, and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

The precious metal is considered

“the anti-dollar,” historically having a

negative correlation to the

U.S. currency.

Worse still, doubts have arisen over whether gold remains a good hedge against disaster, even if it did shine during the 2008 financial crisis.

The recent troubles in emerging markets, for example, have not given the price a lift. “With the markets and economy doing well, people don’t feel the need to have the defensive protection that they presumably get from gold,” says Byron Wien, a vice chairman in the Private Wealth Solutions Group and an investment strategist at the Blackstone Group . “In a severe bear market, it likely will provide some protection, but in a correction in a bull market, it may or not.”

Last month, Wien held his annual series of lunches with 100 leading investors and others in the Hamptons. There was little interest in gold.

For those who are interested in gold, there are plenty of ways to play it. Commodity exchange-traded funds include the industry-leading SPDR Gold Trust (GLD), trading around $114, and the lower-fee (IAU), now around $11.50. The SPDR ETF has an annual fee of 0.4%, and the iShares, 0.25%. The newer MiniShares Trust (GLDM), at $12, has a fee of just 0.18%.

It’s a measure of gold’s unpopularity that the size of the SPDR ETF is now $29 billion, about a 10th the size of the largest equity exchange-traded fund, the (SPY). When gold peaked at about $1,900 in 2011, the two ETFs were around the same size at $75 billion.

Indeed, open-end precious-metals mutual funds have had a decade to forget. On average, they’ve fallen 5% annually, according to Morningstar. Big funds include Fidelity Select Advisor Gold Portfolio (FSAGX), First Eagle Gold (SGGDX), and VanEck International Investors Gold (INIVX).

In July, Vanguard announced that the $1.8 billion Vanguard Precious Metals & Mining fund (VGPMX), the largest gold-oriented U.S. mutual fund, would be renamed Vanguard Global Capital Cycles later this month and that its precious-metal mining exposure would be reduced in favor of other commodity-related industries and global infrastructure, such as telecommunications. Gold and precious-metals mining stocks will make up at least 25% of the fund.

Gold bulls see the action as a sign of capitulation. Vanguard’s move in 2001 to take the “gold” out of the fund name and broaden its mandate coincided with a bottom at about $255 an ounce.

Some closed-end funds own physical gold. For example, Sprott Gold & Silver Trust (CEF), holds roughly two-thirds of its assets in gold and a third in silver. That longstanding fund, formerly known as the Central Fund of Canada , trades around $11.75, a 4% discount to its net asset value. Toronto-based Sprott also runs the Sprott Physical Gold Trust (PHYS). Both funds, unlike the SPDR ETF, allow holders to take physical delivery of the yellow metal. This appeals to survivalists, who populate the ranks of gold bugs.

Gold-mining stocks, like other natural-resource producers, can offer a leveraged play on the commodity. When gold prices rise, mining earnings typically increase by a greater percentage. Take a mining company with an all-in cost of $1,000 per ounce. If gold rises 25%, to $1,500, profits could more than double, with margins going from $200 to $500 an ounce.

Now however, gold-mining shares are even more depressed than the metal itself because financial leverage cuts both ways. The largest gold-mining ETF, the $8 billion VanEck Vectors Gold Miners (GDX), is down 19% this year, to about $19, after hitting a 52-week low recently. Its largest holdings include industry leaders Newmont Mining (NEM), Barrick Gold, Newcrest Mining (NCMGY), Goldcorp (GG), and Franco-Nevada.

Mining companies have many challenges, to be sure. Countries in Africa and elsewhere are trying to gain greater control of their resources, and projects can face environmental opposition. Major finds are rare. But the mining companies are showing greater capital discipline and now trade at historically low levels of cash flow.

Reflecting the frustration with the miners’ performance, a group including billionaire hedge fund manager John Paulson announced on Friday the formation of a coalition of 16 investment managers called the Shareholders’ Gold Council to publish research and “promote best practices” in the industry.

Newmont is the industry leader with a $17 billion market value, a strong balance sheet with under $1 billion of net debt, and a dividend yield of almost 2%. The only gold stock in the S&P 500, it trades for $31, or 24 times projected 2018 earnings of $1.30 a share. That’s not a cheap multiple, but Newmont and other big miners rarely trade at low price/earnings ratios and often are evaluated on their “option” value, meaning they offer a long-term play on potentially higher gold prices.

“Newmont has been one of the most successful majors in fixing its balance sheet and rebuilding its production,” says John Bridges, a mining analyst with JPMorgan. He has an Overweight rating on the stock, with a $40 price target. Newmont’s production is seen holding steady at about five million ounces annually over the next five years.

Newmont’s gold output generally comes from relatively safe locations, with North America and Australia accounting for about 70% of it. Bridges says that the U.S. is now viewed as one of the best places to mine gold, thanks to the cut in the corporate tax rate and other tax breaks. So, Newmont and other miners are expanding domestically.

Barrick Gold has been a turnaround story. In recent years, the company has cut debt by nearly $10 billion, to $5 billion, through asset sales and internally generated cash flow. The shares, at about $10.50, trade for 19 times projected 2018 earnings of 55 cents a share and yield just over 1%.

The driving force at Barrick has been its chairman, John Thornton, a former top Goldman Sachs executive. Reflecting his Goldman roots, he has sought to bring what he calls a “partnership culture” to Barrick. He wants the company to focus on increasing shareholder returns and not fall into a common industry trap of chasing “ounces,” or production, without regard to costs.

“Barrick is a relatively low-cost operator, with people at the top who are focused on profitable capital allocation, rather than growth for growth’s sake,” says Trauner, the GoodHaven portfolio manager, which holds Barrick. He argues that at its current share price, Barrick offers a nearly free option on higher gold prices. In a better environment, the stock could be a lot higher. Barrick earned more than $4 a share and traded at $50 in 2011 when gold peaked at $1,900 an ounce.

The knock on Barrick is that Thornton’s focus on returns has gone too far and that the miner’s annual gold production, which is expected to decline to about 4.75 million ounces this year from 5.3 million ounces in 2017, could drop further. The company has run into political problems with mines in Argentina and Tanzania.

“Barrick fixed the balance sheet and stabilized the business. Now, it needs to show that it can grow in a sensible way,” Trauner says. Some think that Barrick could become a takeover target for a Chinese buyer. Thornton has cultivated a strong relationship with the Chinese, with Shandong Gold buying a half-interest in a large South American mine from Barrick.

Franco-Nevada has been the top-performing major gold-mining stock since its inception in late 2007, returning 16% annually, handily topping the metal, the VanEck ETF, and the S&P 500 index.

The company owes its success to an attractive portfolio of assets and a capital-light business model that give investors effective exposure to the equivalent of nearly 500,000 ounces of annual gold production. Franco-Nevada doesn’t own or operate mines. Instead, it makes investments in new and existing gold, precious metals, and energy assets in return for revenue streams from ongoing production. Franco-Nevada’s operating margins of 70% to 80% are double that of the typical miner.

Lassonde, the Franco-Nevada chairman, calls it “the best business model on the planet” because of its exposure to a growing portfolio of what he considers to be appealing mining properties. The company has just 31 employees.

Tell Us What You Think

Would you consider investing now in gold or in shares of gold mining companies? Write us at mail@barrons.com and we may publish you take. Find out more at barrons.com/mailbag.

Investors have recognized Franco-Nevada’s strengths: The company, whose shares trade around $65, fetches 53 times estimated 2018 earnings. The stock yields 1.5%.

Bridges, the JPMorgan analyst, calls Franco-Nevada the “Mercedes” of the gold-mining industry because the company has been able to protect investors in down gold markets while giving them upside in a rising market. He carries a Neutral rating on the shares with an $85 price target. With the stock down from a peak of $85 in late 2017, investors can get the Mercedes at a discount.

U.S. stocks are at record levels exactly at a time when global stress—trade tensions, populist nationalism, and the like—appears to be growing. This may be an opportune moment for investors to shift at least a portion of their portfolios to gold: both the metal and depressed mining shares.

To flip Buffett’s phrase, gold may do more than just look back at you in the coming years.

Gold is cheap. Inflation is coming. You do the math

13 posts

• Page 1 of 1

Gold is cheap. Inflation is coming. You do the math

When I die, I want to go like Grandpa did. He died in his sleep..... Not screaming and hollering like all the passengers in his car.

-

Sheikh_yer_Bu'Tay - Super Post Hoarder

- Posts: 3111

- Joined: Sun Jun 27, 2010 10:00 am

Re: Gold is cheap. Inflation is coming. You do the math

Speaking of gold... Not much of it for sale here these days. Some silver but not a lot of gold.

In the game of Woke, the goal posts can be moved at any moment, the penalties will apply retroactively and claims of fairness will always lose out to the perpetual right to claim offense.... Bret Stephens

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

-

68Camaro - Too Busy Posting to Hoard Anything Else

- Posts: 8674

- Joined: Thu Dec 30, 2010 6:12 am

- Location: Disney World

Re: Gold is cheap. Inflation is coming. You do the math

68Camaro wrote:Speaking of gold... Not much of it for sale here these days. Some silver but not a lot of gold.

I'm just speculating, but, in general, I imagine that holders of gold are generally more affluent (and less likely to panic) than holders of silver. Regarding gold mining stocks, that may be a different matter altogether.

Former stock broker w/ ~20 yrs. at one company. Spoke with 100k+ people and traded a lot (long, short, options, margin, extended hours, etc.).

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

- Recyclersteve

- Too Busy Posting to Hoard Anything Else

- Posts: 4715

- Joined: Sun Jan 20, 2013 5:59 am

- Location: Where I Want To Be

Re: Gold is cheap. Inflation is coming. You do the math

There are a lot of speculative conclusions in regards to the relationships between interest rates, inflation, and gold price in this article. I hesitate to take any of it at face value without seeing the way in which these factors were concluded to be correlated. So many people keep thinking that inflation = gold price up. But, I challenge someone to do the real pencil and paper charting analysis based on real numbers... and if they do that, to take it to the next step and calculate true correlation. And then, after that, check that correlation value against the correlation of gold to many other factors to see which factor is the most closely correlated to the gold price.

I contend that inflation and gold price may seem to be correlated, but they really are not. Both are reflections of some other factor. Therefore, one cannot be an indicator of the other. The real correlation is X, and X can indicate gold price. But, X does not equal "inflation"

So, what is X, and how did you determine that?

I contend that inflation and gold price may seem to be correlated, but they really are not. Both are reflections of some other factor. Therefore, one cannot be an indicator of the other. The real correlation is X, and X can indicate gold price. But, X does not equal "inflation"

So, what is X, and how did you determine that?

Brick and mortar shop: buy, sell, and trade anything precious- coins, bullion, scrap, jewelry, gems, etc.

http://marketharmony.net

Follow me on Twitter- @MarketHarmony

http://marketharmony.net

Follow me on Twitter- @MarketHarmony

-

Market Harmony - Super Post Hoarder

- Posts: 3256

- Joined: Fri Feb 13, 2009 3:00 pm

- Location: 657 Evergreen Ave, First Floor, Pittsburgh, PA 15209

Re: Gold is cheap. Inflation is coming. You do the math

Market Harmony wrote:There are a lot of speculative conclusions in regards to the relationships between interest rates, inflation, and gold price in this article. I hesitate to take any of it at face value without seeing the way in which these factors were concluded to be correlated. So many people keep thinking that inflation = gold price up. But, I challenge someone to do the real pencil and paper charting analysis based on real numbers... and if they do that, to take it to the next step and calculate true correlation. And then, after that, check that correlation value against the correlation of gold to many other factors to see which factor is the most closely correlated to the gold price.

I contend that inflation and gold price may seem to be correlated, but they really are not. Both are reflections of some other factor. Therefore, one cannot be an indicator of the other. The real correlation is X, and X can indicate gold price. But, X does not equal "inflation"

So, what is X, and how did you determine that?

Just a stupid wild guess:

When I die, I want to go like Grandpa did. He died in his sleep..... Not screaming and hollering like all the passengers in his car.

-

Sheikh_yer_Bu'Tay - Super Post Hoarder

- Posts: 3111

- Joined: Sun Jun 27, 2010 10:00 am

Re: Gold is cheap. Inflation is coming. You do the math

I believe that you missed my point... you just reiterated that "X" = inflation. My supposition and contention is that the same factor that drives gold price also drives inflation. Therefore, looking at gold price is the same as looking at inflation inversely, but what you cannot see is the factor behind the delta. To say it a different way, what is causing delta? The chart above is an observation of the result of that factor on the market, but does not identify what exactly is that factor.

Brick and mortar shop: buy, sell, and trade anything precious- coins, bullion, scrap, jewelry, gems, etc.

http://marketharmony.net

Follow me on Twitter- @MarketHarmony

http://marketharmony.net

Follow me on Twitter- @MarketHarmony

-

Market Harmony - Super Post Hoarder

- Posts: 3256

- Joined: Fri Feb 13, 2009 3:00 pm

- Location: 657 Evergreen Ave, First Floor, Pittsburgh, PA 15209

Re: Gold is cheap. Inflation is coming. You do the math

Market Harmony wrote:I believe that you missed my point... you just reiterated that "X" = inflation. My supposition and contention is that the same factor that drives gold price also drives inflation. Therefore, looking at gold price is the same as looking at inflation inversely, but what you cannot see is the factor behind the delta. To say it a different way, what is causing delta? The chart above is an observation of the result of that factor on the market, but does not identify what exactly is that factor.

-

natsb88 - Too Busy Posting to Hoard Anything Else

- Posts: 8428

- Joined: Thu May 01, 2008 3:00 pm

- Location: The Copper Cave

Re: Gold is cheap. Inflation is coming. You do the math

Market Harmony wrote:I believe that you missed my point... you just reiterated that "X" = inflation. My supposition and contention is that the same factor that drives gold price also drives inflation. Therefore, looking at gold price is the same as looking at inflation inversely, but what you cannot see is the factor behind the delta. To say it a different way, what is causing delta? The chart above is an observation of the result of that factor on the market, but does not identify what exactly is that factor.

Hey, I told you it was just a stupid wild guess.

I would love to discover the factor you speak of. Me finding that on my own would probably be equal to my finding a 1983D Copper penny!

Fill me in MH. What is this factor you speak of?

When I die, I want to go like Grandpa did. He died in his sleep..... Not screaming and hollering like all the passengers in his car.

-

Sheikh_yer_Bu'Tay - Super Post Hoarder

- Posts: 3111

- Joined: Sun Jun 27, 2010 10:00 am

Re: Gold is cheap. Inflation is coming. You do the math

I believe its complicated but related to total per capita uncorrected income, or maybe it's total national income. But for example per capita income in 1967 was $2464 (yep, per year) whereas it was $34489 in 2017. Those are current dollars not adjusted. This is connected to how much money can be spent by the nation, which affects prices and thus inflation. But other things go into it like debt.

In the game of Woke, the goal posts can be moved at any moment, the penalties will apply retroactively and claims of fairness will always lose out to the perpetual right to claim offense.... Bret Stephens

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

-

68Camaro - Too Busy Posting to Hoard Anything Else

- Posts: 8674

- Joined: Thu Dec 30, 2010 6:12 am

- Location: Disney World

Re: Gold is cheap. Inflation is coming. You do the math

Sheikh_yer_Bu'Tay wrote: What drives price has always been demand, or the lack thereof, so "X" would equal demand. That, however is too simplistic in a market that is constantly being manipulated.

Totally agree.

Former stock broker w/ ~20 yrs. at one company. Spoke with 100k+ people and traded a lot (long, short, options, margin, extended hours, etc.).

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

- Recyclersteve

- Too Busy Posting to Hoard Anything Else

- Posts: 4715

- Joined: Sun Jan 20, 2013 5:59 am

- Location: Where I Want To Be

Re: Gold is cheap. Inflation is coming. You do the math

The more I think about Market Harmony's postings the more I have to agree with him in principle. "X" equals demand. The price of gold and inflation are not necessarily wed to each other in an inverse correlation, but it's real, real close.

When the gold boom of the late 70s hit there was indeed inflation, but the true driver of demand for gold at that time was fear of WW3 breaking out. OPEC countries were awash with fiat US FRNs and wanted something that held intrinsic value. Americans stood in long lines to sell their gold for unheard of prices that topped out around $800 an ozt. Gold price increased 2,500% in less than 10 yrs. all due to demand and the fact the Saudis had more fiat FRNs than they knew what to do with.

When the gold boom of the late 70s hit there was indeed inflation, but the true driver of demand for gold at that time was fear of WW3 breaking out. OPEC countries were awash with fiat US FRNs and wanted something that held intrinsic value. Americans stood in long lines to sell their gold for unheard of prices that topped out around $800 an ozt. Gold price increased 2,500% in less than 10 yrs. all due to demand and the fact the Saudis had more fiat FRNs than they knew what to do with.

When I die, I want to go like Grandpa did. He died in his sleep..... Not screaming and hollering like all the passengers in his car.

-

Sheikh_yer_Bu'Tay - Super Post Hoarder

- Posts: 3111

- Joined: Sun Jun 27, 2010 10:00 am

Re: Gold is cheap. Inflation is coming. You do the math

It's a good volume of work to determine what "X" is for any event. And I have the feeling that whatever factor "X" is determined to be will change upon the time continuum. Maybe after exhausting oneself in research there is no way to draw a conclusive answer to the driving force of inflation and gold price. Its possibly a stretch, but a scaled analysis could lead to significant financial insight and possibly profitable speculation. If someone were to learn about this, would they risk putting it out for free examination? I doubt it- especially if they did the work on their own. So, maybe we can learn from each other...

What function of "demand" can be an "X" factor?

What function of "demand" can be an "X" factor?

Brick and mortar shop: buy, sell, and trade anything precious- coins, bullion, scrap, jewelry, gems, etc.

http://marketharmony.net

Follow me on Twitter- @MarketHarmony

http://marketharmony.net

Follow me on Twitter- @MarketHarmony

-

Market Harmony - Super Post Hoarder

- Posts: 3256

- Joined: Fri Feb 13, 2009 3:00 pm

- Location: 657 Evergreen Ave, First Floor, Pittsburgh, PA 15209

Re: Gold is cheap. Inflation is coming. You do the math

Link in the OP is to the wrong article. This is the correct link: https://www.barrons.com/articles/gold-i ... 1537582480

The journey of a thousand miles begins with a single step. -Lao Tzu

You can find me ranting at clouds on pmbug.com.

You can find me ranting at clouds on pmbug.com.

-

pmbug - Penny Collector Member

- Posts: 368

- Joined: Sat Dec 10, 2011 4:00 pm

- Location: Uncle Scrooge's Vault

13 posts

• Page 1 of 1

Return to Economic & Business News, Reports, and Predictions

Who is online

Users browsing this forum: No registered users and 19 guests