https://www.cnbc.com/quotes/MSTR

Hey Recyclersteve, MSTR of no interest to you?

Re: Hey Recyclersteve, MSTR of no interest to you?

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

MSTR now down to $331 from a high of $543 in November.

A loss of 39% from the ATH.

https://www.cnbc.com/quotes/MSTR

A loss of 39% from the ATH.

https://www.cnbc.com/quotes/MSTR

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

I think MSTR is down so sharply because they use leverage. This is your best friend when something is going up and worst enemy when it is going down.

Former stock broker w/ ~20 yrs. at one company. Spoke with 100k+ people and traded a lot (long, short, options, margin, extended hours, etc.).

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

NOTE: ANY stocks I discuss, no matter how compelling, carry risk- often

substantial. If not prepared to buy it multiple times in modest amounts without going overboard (assuming nothing really wrong with the company), you need to learn more about the market and managing risk. Also, please research covered calls (options) and selling short as well.

- Recyclersteve

- Too Busy Posting to Hoard Anything Else

- Posts: 4715

- Joined: Sun Jan 20, 2013 5:59 am

- Location: Where I Want To Be

Re: Hey Recyclersteve, MSTR of no interest to you?

Recyclersteve wrote:I think MSTR is down so sharply because they use leverage. This is your best friend when something is going up and worst enemy when it is going down.

Their story has not even begun. We're not in Chapter 1. We are still looking at the Preface.

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

Peter Schiff replying to Michael Saylor's latest Bitcoin purchase...

https://x.com/PeterSchiff/status/1871190578890944809

It seems like you are running out of firepower to keep propping up Bitcoin. Plus, not only is this your smallest buy, but the first time your average purchase price has been above the market price on the Monday you disclosed the buy.

https://x.com/PeterSchiff/status/1871190578890944809

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Recyclersteve wrote:I think MSTR is down so sharply because they use leverage. This is your best friend when something is going up and worst enemy when it is going down.

Your ideas are not wrong, except that is not what caused MSTR to trade down.

Rather, they have issued $14B of MSTR stock "at the market" in less than 2 months which has absorbed all buying pressure. Simultaneously, they have come under short attack by hedge funds who think MSTR is the same as Bitcoin, when in fact its a way to grow your bitcoin. Those shorts are going to unwind in a massive short-covering rally in Feb-March (after MSTR announces earnings, I expect them to issue as much as $18B of convertible debt). I have confidence that MSTR will issue that debt because:

-they announced $21B of equity and $21B of at the end of Oct 2024

-already raised $14B equity and $3B of debt

-the convertible debt is issued at a premium to current market value, meaning MSTR shareholders accrete bitcoin-per-share upon such issuances.

-MSTR's Chairman wants to "go fast" and buy bitcoin before the price rises further.

I would not be surprised if MSTR doubles its Bitcoin per share by the end of 1Q2025.

Smoke 'em if you've got 'em!

-

Lemon Thrower - Too Busy Posting to Hoard Anything Else

- Posts: 4172

- Joined: Fri Jun 13, 2008 10:00 am

Re: Hey Recyclersteve, MSTR of no interest to you?

MicroStrategy dilutes its shareholders to buy more bitcoin

https://protos.com/microstrategy-dilute ... e-bitcoin/

Unlike BTC, MSTR is nowhere close to its all-time high. Although the stock is one of the best-performing large-cap stocks this year, it’s one-fifth below its November 21 pre-market print of $548.20.

Around that time, Saylor also lost voting control over MicroStrategy. He’s now a minority voter and chairman, prohibited from serving as the company’s CEO due to a 2022 legal settlement.

Some shareholders are growing weary of Saylor’s strategy of selling shares “at the market (ATM)” — i.e. at prevailing market prices, with no discount — in order to acquire more BTC.

Saylor has announced $21 billion worth of ATM sales in his current round of financing, which is still underway.

These sales instantly dilute shareholders while simultaneously increasing the company’s BTC holdings — assuming all of the proceeds are used to acquire BTC, which has been the case in recent months.

https://protos.com/microstrategy-dilute ... e-bitcoin/

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Lemon Thrower wrote:Recyclersteve wrote:I think MSTR is down so sharply because they use leverage. This is your best friend when something is going up and worst enemy when it is going down.

Your ideas are not wrong, except that is not what caused MSTR to trade down.

Rather, they have issued $14B of MSTR stock "at the market" in less than 2 months which has absorbed all buying pressure. Simultaneously, they have come under short attack by hedge funds who think MSTR is the same as Bitcoin, when in fact its a way to grow your bitcoin. Those shorts are going to unwind in a massive short-covering rally in Feb-March (after MSTR announces earnings, I expect them to issue as much as $18B of convertible debt). I have confidence that MSTR will issue that debt because:

-they announced $21B of equity and $21B of at the end of Oct 2024

-already raised $14B equity and $3B of debt

-the convertible debt is issued at a premium to current market value, meaning MSTR shareholders accrete bitcoin-per-share upon such issuances.

-MSTR's Chairman wants to "go fast" and buy bitcoin before the price rises further.

I would not be surprised if MSTR doubles its Bitcoin per share by the end of 1Q2025.

The ETFs -- like BlackRock's -- were already buying 10 times the amount of newly mined Bitcoin. Now more corps and countries are getting involved. Saylor is front-running them all. Since Bitcoin is going to $1 Million, everyone should consider it cheap now. As is MSTR.

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

MicroStrategy’s over-leveraged Bitcoin gamble mirrors FTX’s collapse—10 billion share dilution looms. Effects are delayed, enabling Saylor to exit profitably before consequences unfold.

https://citizenwatchreport.com/microstr ... nsequence/

https://citizenwatchreport.com/microstr ... nsequence/

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

MicroStrategy and Its Convertible Debt Scheme

https://www.advisorperspectives.com/art ... ebt-scheme

We think MicroStrategy is preying on investors. It is pumping up optimism on bitcoin to drive higher volatility in its stock. Doing so allows it to raise funds and add to its bitcoin holdings. Its convertible funding strategy is legal, but the risks to its shareholders and bondholders are much more significant than many of its investors appreciate.

https://www.advisorperspectives.com/art ... ebt-scheme

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

MicroStrategy Stock (MSTR) Price Plunges 8% After Latest BTC Buy Amid Fears Of The Firm’s Leveraged Bitcoin Play

https://insidebitcoins.com/news/microst ... tcoin-play

The share price of MicroStrategy stock (MSTR) plunged 8% after the firm purchased $209 million worth of Bitcoin (BTC) amid growing concerns of the company’s “leveraged” play.

MSTR lost over $27 during yesterday’s trading session, according to data from Google Finance.

https://insidebitcoins.com/news/microst ... tcoin-play

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

More BTC purchased by MSTR.

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

Cost basis per Bitcoin at MSTR now 62K...

What happens when Bitcoin crashes again?

What happens when Bitcoin crashes again?

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

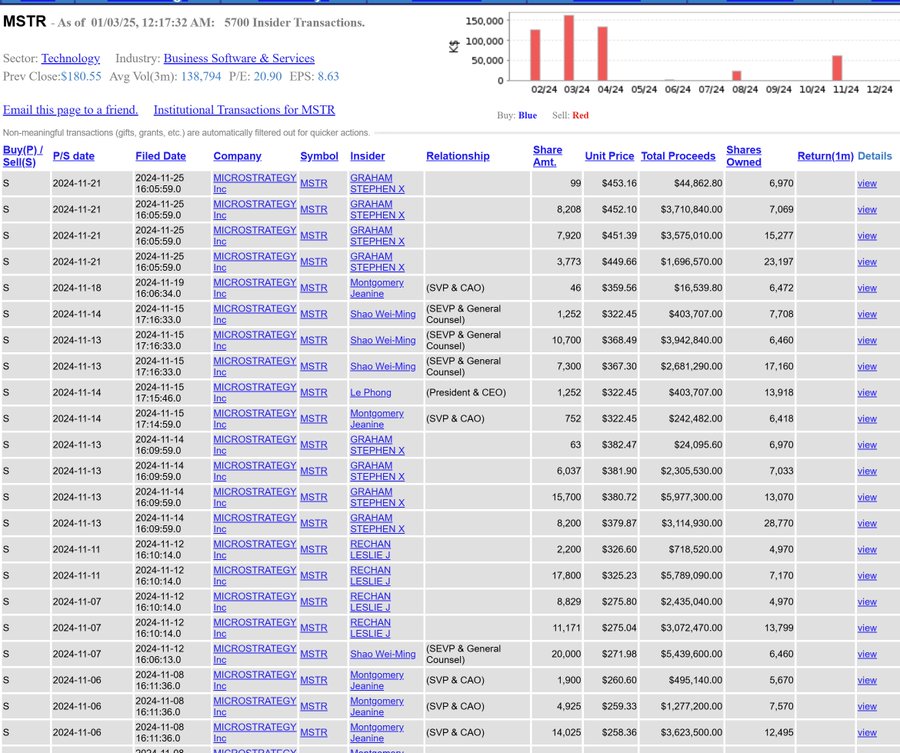

$MSTR insider sales update:

Now up to 5,700 transactions. 99.998% are insider sales... dumping their shares. From the Legal Council to the President and CEO, sell sell sell.

https://x.com/goldseek/status/1875050004894859327

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Coinbase, MicroStrategy execs among largest stock sellers last year

https://blockworks.co/news/largest-stock-sellers-2024

MicroStrategy alpha bull Michael Saylor came 13th with $410.8 million.

https://blockworks.co/news/largest-stock-sellers-2024

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Michael Saylor’s MicroStrategy purchased more Bitcoin today.

Notice how each time they buy, the position amount shrinks drastically (avg, -52%).

Jan 6: $101M

Dec 30: $209M

Dec 23: $561M

Dec 16: $1.5B

Dec 09: $2.1B

They’re running out of cash and the momentum is drying up. Tick tock.

https://x.com/JacobKinge/status/1876270296161738886

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

That's an interesting observation...

In the game of Woke, the goal posts can be moved at any moment, the penalties will apply retroactively and claims of fairness will always lose out to the perpetual right to claim offense.... Bret Stephens

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

The further a society drifts from the truth, the more it will hate those that speak it. George Orwell.

We can ignore reality, but we cannot ignore the consequences of ignoring reality. Ayn Rand.

-

68Camaro - Too Busy Posting to Hoard Anything Else

- Posts: 8674

- Joined: Thu Dec 30, 2010 6:12 am

- Location: Disney World

Re: Hey Recyclersteve, MSTR of no interest to you?

tdtwedt wrote:Cost basis per Bitcoin at MSTR now 62K...

What happens when Bitcoin crashes again?

Bitcoin now 91K. Will Saylor have to sell his Bitcoin if it crashes below 62K?

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Why have MicroStrategy insiders been dumping MSTR?

https://protos.com/why-have-microstrate ... ping-mstr/

As MicroStrategy (MSTR) continues to dilute and supersede common shareholders to add bitcoin (BTC) to its balance sheet, company insiders continue to sell into their bids.

While its leaders boast about the company’s long-term prospects, multi-million dollar BTC price forecasts, and accretive BTC purchases, many well-informed executives are selling shares for personal compensation.

https://protos.com/why-have-microstrate ... ping-mstr/

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Hey, Steve. You said you had exited your MSTR position. Here's some news that came out today:

MicroStrategy price target raised to $613 from $581 at Cantor Fitzgerald

Jan. 13, 2025, 06:15 AM

Cantor Fitzgerald raised the firm’s price target on MicroStrategy (MSTR) to $613 from $581 and keeps an Overweight rating on the shares. MicroStrategy “delivered a record year” in terms of Bitcoin (BTC) treasury operations, adding 258,320 Bitcoin during 2024, the analyst tells investors. Bitcoin per share increased by 74.3% and the market value of its Bitcoin position increased by 414.5%, adds the analyst, who notes that in the middle of 2024 the company’s long-term target was for it to own 1% of all Bitcoin that will ever be created and pointing out the the company “is already at 2.1%.” <end quote>

I'm sure you know who Cantor Fitzgerald is. The new Trump Admin Commerce Secretary is expected to be Howard Lutnick, the CEO of Cantor. What do you think the insiders in Washington know about Bitcoin, and by extension, about MSTR?

MicroStrategy price target raised to $613 from $581 at Cantor Fitzgerald

Jan. 13, 2025, 06:15 AM

Cantor Fitzgerald raised the firm’s price target on MicroStrategy (MSTR) to $613 from $581 and keeps an Overweight rating on the shares. MicroStrategy “delivered a record year” in terms of Bitcoin (BTC) treasury operations, adding 258,320 Bitcoin during 2024, the analyst tells investors. Bitcoin per share increased by 74.3% and the market value of its Bitcoin position increased by 414.5%, adds the analyst, who notes that in the middle of 2024 the company’s long-term target was for it to own 1% of all Bitcoin that will ever be created and pointing out the the company “is already at 2.1%.” <end quote>

I'm sure you know who Cantor Fitzgerald is. The new Trump Admin Commerce Secretary is expected to be Howard Lutnick, the CEO of Cantor. What do you think the insiders in Washington know about Bitcoin, and by extension, about MSTR?

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

So I watched a mini-documentary on quantum computing since Google has recently come out with their "Willow project" which is their quantum computer. Frankly, after I watched I was blown away (not in a good way) by what quantum computing has the potential to do. But one of the things they mentioned was that with quantum computing, code breaking becomes child's play. I forget the numbers that they mentioned but of course they brought up (briefly) bitcoin and how right now one of the attractive features of bitcoin is it's privacy, it's safety within a wallet and it's limited number (21 million coins). This documentary (and who knows if they are correct) implied that all codes would become useless if quantum computing took over and bitcoin would no longer be of any use because it's coding and block chain and algo rhythms would be completely "cracked" for lack of a better term, by the quantum computing capabilities.

If I find the link to the video I will post. But in the meantime, I am just adding one more ingredient to the pot here. And, yes, I will disclose again, I have a small bitcoin stake.

If I find the link to the video I will post. But in the meantime, I am just adding one more ingredient to the pot here. And, yes, I will disclose again, I have a small bitcoin stake.

-

silverflake - 1000+ Penny Miser Member

- Posts: 1078

- Joined: Wed Nov 24, 2010 9:49 pm

- Location: Virginia

Re: Hey Recyclersteve, MSTR of no interest to you?

Theoretically they are correct but in reality that is about 20 years away because quantum computing is very unreliable - the error rate is remarkably high.

And its orders of magnitude easier to crack passwords like those used by Google or the Fed or your bank.

Meanhwile, Sam Altman says general AI will be reached in 2025 and some knowledgeable people think we will have hundreds of million general-AI equipped humanoid robots by the end of the decade.

And its orders of magnitude easier to crack passwords like those used by Google or the Fed or your bank.

Meanhwile, Sam Altman says general AI will be reached in 2025 and some knowledgeable people think we will have hundreds of million general-AI equipped humanoid robots by the end of the decade.

Smoke 'em if you've got 'em!

-

Lemon Thrower - Too Busy Posting to Hoard Anything Else

- Posts: 4172

- Joined: Fri Jun 13, 2008 10:00 am

Re: Hey Recyclersteve, MSTR of no interest to you?

silverflake wrote:So I watched a mini-documentary on quantum computing since Google has recently come out with their "Willow project" which is their quantum computer. Frankly, after I watched I was blown away (not in a good way) by what quantum computing has the potential to do. But one of the things they mentioned was that with quantum computing, code breaking becomes child's play. I forget the numbers that they mentioned but of course they brought up (briefly) bitcoin and how right now one of the attractive features of bitcoin is it's privacy, it's safety within a wallet and it's limited number (21 million coins). This documentary (and who knows if they are correct) implied that all codes would become useless if quantum computing took over and bitcoin would no longer be of any use because it's coding and block chain and algo rhythms would be completely "cracked" for lack of a better term, by the quantum computing capabilities.

If I find the link to the video I will post. But in the meantime, I am just adding one more ingredient to the pot here. And, yes, I will disclose again, I have a small bitcoin stake.

Your concern is expertly answered by none other Michael Saylor in 1 minute and 26 seconds. Please click on the link.

https://x.com/staysovereign/status/1875263711285539103

Additionally, the Bitcoin network, made up of a bunch of "nodes" is the most powerful computer network in the world. Even if Bitcoin got hacked, given the decentralized nature of the protocol, every node participant would know where changes to the network were made. I think it's a minor concern at this point.

Solution: Buy more Bitcoin and keep it in a cold storage wallet.

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

If you like the US Navy, if you like computers the video at the link below is only 5 minutes.

https://x.com/Vivek4real_/status/1713136483136049552

https://x.com/Vivek4real_/status/1713136483136049552

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Return to Economic & Business News, Reports, and Predictions

Who is online

Users browsing this forum: No registered users and 17 guests